BNPL vs IPP: Which Suits Your Business?

Many of my clients are always on the lookout for innovative and savvy payment options that give their customers more flexibility and convenience to pay for items.

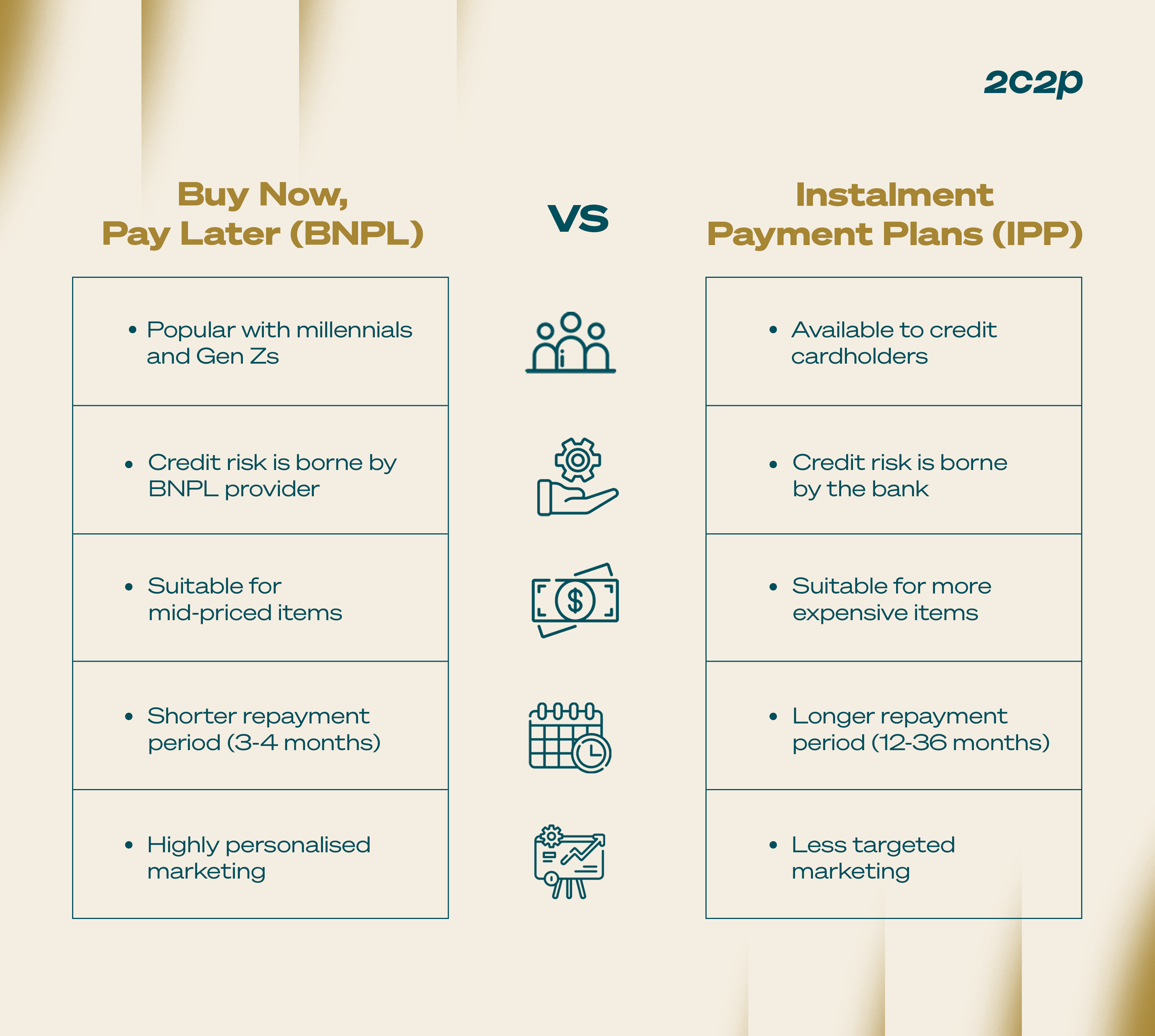

Buy Now, Pay Later (BNPL) has emerged as a leading trend in the past year because it helps consumers break up large payments into more manageable sums. But for some, BNPL’s concept might sound familiar: Instalment Payment Plans (IPP), which have been around for much longer, essentially share the same concept.

While BNPL is similar to IPP, there are several key differences that set them apart from each other. In this article, I’ll walk through the similarities and differences of IPP and BNPL.

What are Instalment Payment Plans (IPPs)?

As IPP came first, let’s start by understanding what it is. In a nutshell, IPPs are tied to bank credit cards, breaking up your large purchases into smaller monthly payments of up to 36 months. The critical point is that IPPs are only possible with credit cards because they come with a credit limit.

While IPPs are a fantastic way to give you breathing space when you make big-ticket purchases, your monthly payments are only interest-free so long as you settle them on time.

When you default on just one payment, your credit score will be impacted. In some countries, banks may even charge you a small interest fee for using the IPP service.

What is Buy Now, Pay Later (BNPL)?

Now that we’ve understood what IPPs are and how they work, let's talk about Buy Now Pay Later (BNPL). BNPL is basically a short-term financing plan that allows you to pay for your purchases in instalments of between 3 to 4 months.

BNPL has become the talk of the town in recent years. This is especially true in Southeast Asia, where people across the region have been avidly adopting this payment solution.

In fact, according to an IDC report commissioned by 2C2P, BNPL spending in Southeast Asia will expand by $7.9 billion between 2020 and 2025 - that’s an increase of at least 8.8x!

Below are the projected growth rates of BNPL in Southeast Asia markets from 2019 to 2025:

- Indonesia: 1% → 6%

- Malaysia: 1% → 5%

- Philippines: 0% → 4%

- Singapore: 2% → 6%

- Thailand: 1% → 4%

- Vietnam: 0% → 3%

For an insider’s glimpse into the world of BNPL, tune in to the podcast interview we did with hoolah founder and CEO Arvin Singh.

BNPL vs IPP: Similarities

BNPL and IPP share two key similarities, as explained below.

#1: Instalment-based plans

Both BNPL and IPP are instalment-based plans. They break up the cost of your purchases into bite-sized instalments that you pay off over a period of time.

#2: Interest-free

Both BNPL and IPP instalments are typically interest-free. Late payment fees apply for both types of instalment plans. For BNPL, late payments could potentially rack up high interest rates above 25%. As for IPP, late charges are typically determined via a flat rate.

BNPL vs IPP: Differences

Despite their similarities, BNPL and IPP actually differ from each other in many ways. Let’s move on to explore what some of these key differences are.

#1: The need for a credit card

Right off the bat, BNPL and IPP differ in terms of whether a credit card is required. As mentioned earlier, IPPs are tied to bank credit cards. The total amount you can charge to IPPs is determined by the bank overseeing your credit card.

As for BNPL, you are not required to own a credit card to use it. This is because it falls outside of credit regulations that only apply to banks and credit cards.

#2: Target demographics and tailored marketing

As BNPL does not require a credit card, it is thus more popular with millennials and Gen Zs. These younger people (students, first jobbers, freelancers etc.) may not fulfil the income requirements for a credit card, but are still an important customer demographic with significant purchasing power.

In addition to this, BNPL services are housed in convenient mobile apps, making them easily accessible to tech-savvy millennials and Gen Zs. Atome, hoolah, and Pace have their own proprietary apps, while Grab and Shopee have incorporated a PayLater function into their respective “super apps”.

BNPL typically targets customers based on data shared and provides a hyper-personalised shopping experience.

IPPs are different. These plans often don’t target specific demographics and are marketed towards the broader cardholding public. Unlike BNPL, IPPs do require you to own a credit card, which in turn comes with its own set of application requirements. In Singapore, for example, the Monetary Authority of Singapore (MAS) stipulates that you must have an income of at least $30,000 in order to qualify for a credit card application.

#3: Credit limit

Between the two plans, IPPs have a higher credit limit. This credit limit is stipulated by your issuing bank, which varies depending on your annual income. As the minimum annual income required to own credit cards is $30,000, the credit limit of IPPs is thus higher, making them suitable for purchasing large-ticket items like a car or high-end household appliances.

To illustrate, let’s say I own a credit card issued by ABC Bank. The bank gives me a credit limit of $10,000, allowing me to make $10,000 worth of purchases in a month. I then decide to purchase a new air-conditioning system for my house costing $5,000, but because I can’t afford to pay it upfront, I take up an IPP spread out over 12 months. My remaining credit limit is then reduced to $5,000 till I make payment.

Conversely, BNPL has a lower credit limit. This makes them more suited for mid-priced items, such as a $500 gaming chair, an $80 blouse, or even that $7 latte.

In Singapore, the basic credit limit for BNPL is $300. But if you choose to share your personal details via SingPass (Singapore citizens' and residents' digital identification service), your credit limit could be increased to $1,500 or more.

#4: Repayment period

As earlier highlighted, the repayment period for IPPs is much longer than BNPL, stretching up to 36 months and beyond. This is because IPPs are usually reserved for large-ticket purchases. In order to keep monthly instalments affordable, the repayment period is extended over a longer period of time.

On the flip side, the lower credit limit of BNPL means that its repayment period is shorter, typically lasting three months. Some BNPL players like Grab have extended this period to four months.

#5: Credit risk

For IPPs, the credit risk is borne by the issuing bank, which is coupled with a stringent Know Your Customer (KYC) process. As for BNPL, the credit risk is borne by the BNPL provider.

BNPL and its impact

I’ve spoken at length about how BNPL works and its strengths, but we must also consider some of the implications that it might have on the wider society.

According to an Adobe Analytics report on the digital economy index, there was a spike of 215% in BNPL loans between January and February 2021, with consumers making 18% larger purchases.

So what’s driving these enormous figures? The fact that BNPL is interest-free. Consumers are attracted to the idea that they don’t have to fret over paying extra interest when they split their purchases into monthly instalments.

In an article on what BNPL means for consumer debt, The Business Times quoted the concerns of industry watchers, who said that BNPL creates “a false sense of affordability and hidden late payment charges that could introduce bad debt.”

In some countries, this is starting to become a reality. The US, for example, has seen a rise in BNPL default rates. According to a survey by Credit Karma, 34% of its respondents who used BNPL services have defaulted on at least one payment - which lowered their credit score.

Back home in Singapore, BNPL hasn’t significantly impacted consumer debt levels. The industry is currently self-regulating to manage risks - the Singapore FinTech Association is launching a code of conduct in the second half of 2022.

This code of conduct will further limit debt accumulation, encompassing a minimum age of 18 years, a cap on interest and late fees, and a freeze on BNPL purchases when payments have defaulted.

I think this code of conduct is for the best, as it introduces some measure of control over how BNPL is used. Call it tough love, if you will, but it’s really in our best interest to have regulations to protect customers from spending beyond our means!

How 2C2P helps merchants choose BNPL or IPP

Over at 2C2P, we are committed to helping our merchants make the right choices that best fit their businesses. This includes deciding between BNPL and IPP.

We start by taking a look at our merchant’s products and/or services. If their offerings are of a larger ticket size, we would recommend them not to adopt BNPL due to its smaller credit limit. Instead, IPP is more ideal as its bigger credit limit is better able to cover the cost of the products.

Ultimately, BNPL and IPP make it easier for consumers to pay as they break payments into bite-sized, manageable instalments. It’s all a matter of choosing the option that works best with our merchants’ products or services.

Specific to BNPL, merchants may choose this option simply because it serves as a gateway for reaching young working adults and students. To this end, 2C2P works with leading BNPL players in each market:

- Singapore: Atome, Grab PayLater, hoolah, Pine Labs

- Indonesia: Akulaku

- Malaysia: Atome, Grab PayLater, hoolah

- Philippines: BillEase, TendoPay

- Thailand: Atome

- Hong Kong: hoolah

BNPL or IPP, responsible spending is the way to go

As Singapore’s Minister of State for Trade and Industry Alvin Tan aptly puts it, BNPL and IPPs "should not be used as a way to buy items that are more expensive than what consumers can afford and do not need.”

While BNPL and IPPs are good for making shopping more enjoyable, be sure to exercise care when taking up either option. The usual golden rules apply: plan ahead and only spend within your means!

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 250 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 400,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further with digital payments? Our friendly team is ready to help - talk to us today.