Popular Payment Methods in Hong Kong: What Consumers Want

A natural crossroad between East and West and a gateway to Mainland China, Hong Kong is one of the world’s leading international financial centres, ranking fourth after London, New York, and Singapore. The densely populated city of over 7.3 million people is also one of the world’s top ten technology and innovation hubs outside of Silicon Valley.

Hong Kong is an increasingly digital-savvy society, with a mobile penetration rate of 320% in November 2021 and an internet penetration rate of 93.1% in February 2023. According to The Asset, Hong Kong has one of the most advanced digital economies, ranking second to Singapore in Asia Pacific and third globally.

Despite this, Hong Kongers are somewhat wary of digital payment solutions. According to Unicard HK, Hong Kong consumers have considerable concerns over data privacy and security. As recently as 2019, 88% of Hong Kong shoppers still used cash when they shopped offline.

However, the Covid-19 pandemic and severe lockdown measures have drastically changed Hong Kong’s payments landscape. Consumer behaviour has altered entirely as a result. To stay competitive, financial institutions must quickly adapt to the fast-evolving payment needs of the local population.

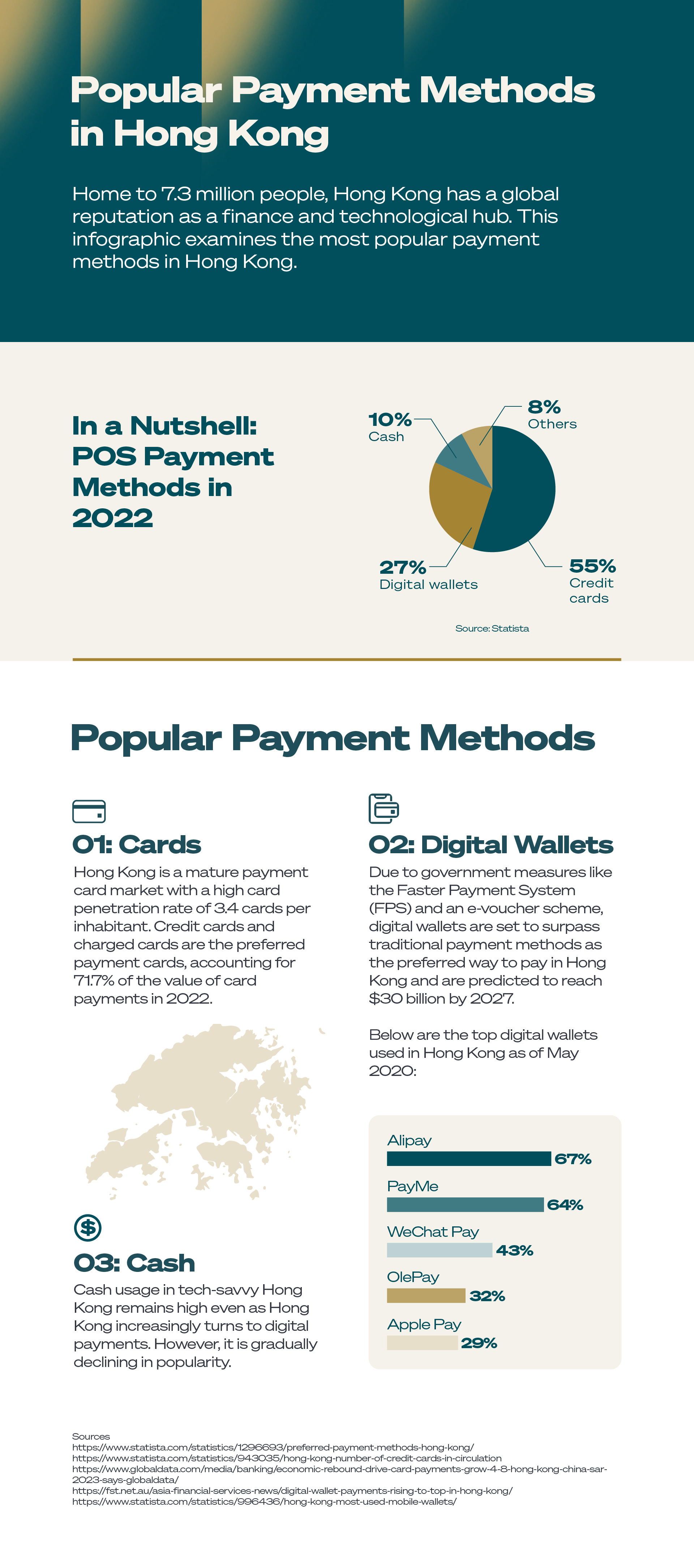

In this article, we will examine Hong Kong’s most popular payment methods, summarised as follows:

- Cards

- Octopus card

- Cash

- Digital wallets

Cards

According to Visa’s Consumer Payment Attitudes Study 4.0, 91% of Hong Kongers use cards as a way to pay, trumping cash, which stands at 82%. This has been driven by the shift in consumer preferences towards cashless payments. According to the Hong Kong Monetary Authority (HKMA), there was a 16.7% increase in the total number of credit card transactions in Q2/2023 compared to the same period in 2022.

Hong Kong is a mature payment card market, recording a high card penetration rate of 3.4 cards per inhabitant. Much of this growth is attributed to its solid and reliable payment infrastructure, leading to consumers preferring credit cards over other online payment methods.

Credit and charge cards are the preferred payment cards, accounting for 71.7% of the value of card payments in 2022. Visa’s study revealed that this preference is mainly due to the associated reward programs, which are more beneficial than debit cards. Notably, 60% of respondents actively track and maximise loyalty rewards.

GlobalData forecasts a 4.6% rise in the value of Hong Kong’s credit and charge card payments in 2023, and expects it to reach US$106.7 billion in 2026.

Debit cards accounted for the remaining 28.3% share of card payments in 2022, with the low usage attributed to the limited acceptance of domestic EPS debit cards.

Octopus card

The Octopus card is a stored-value card that is unique to Hong Kong. Like the EZ-Link Cards used in Singapore, it was originally designed as a quick and easy payment method for public transport. The card has since been expanded into a multi-purpose tool for small retail purchases and personal identification, accepted by more than 18,000 service providers across at least 25,000 retail outlets.

The Octopus card has consistently been one of Hong Kong’s preferred payment methods, constituting 16% of all payments used during Covid-19 in 2020.

According to official figures from Octopus, 98% of Hong Kongers aged between 15 and 64 own Octopus cards, with over 33 million cards and products in active circulation. The card is also accepted at over 140,000 acceptance points, making it a staple tool for the average Hong Konger.

Over the years, the Octopus card has expanded its product range to include the following:

- On-Loan Octopus

- Sold Octopus

- Bank Co-Brand Octopus

- Cross Border Octopus

- Octopus Mobile SIM (a mobile phone SIM card with embedded Octopus functions)

- Octopus on iPhone or Apple Watch

- Huawei Pay Octopus

- Smart Octopus in Samsung Pay

The Octopus card is complemented by a contactless mobile app that gives users the freedom to use their mobile devices to top up their cards and make payments. It even has its own proprietary digital wallet called Octopus Wallet, paired with an optional Mastercard.

Given the multifaceted convenience that the Octopus card affords, it is no surprise that Hong Kongers would integrate its use into their daily lives.

Cash

In 2021, The Chartered Banker declared that cash is still king in Hong Kong. The publication attributed Hong Kong’s love affair with cash to public distrust in smart payments on both the merchant and consumer fronts.

According to Philip Kam, General Manager at the Hong Kong Institute of Bankers,

“The reason why people like cash here is that they simply like the tangible feel of money."

This practice is especially apparent during auspicious festivities like Lunar New Year, when Hong Kongers maintain the tradition of giving and receiving crisp, new notes in red packets.

However, with the cashless momentum growing fast across Hong Kong, cash is gradually declining in popularity. When it comes to a breakdown in monthly expenses, cash was previously top with a 31% share but has now dropped to 25%, and is forecast to fall to 20% within a year. According to Visa, consumers increasingly prefer cashless payments when given the option.

Local government initiatives to drive digital payments

The Hong Kong Monetary Authority (HKMA) steers the cashless movement in Hong Kong, encouraging the use of cashless payment methods. This exercise began with the widespread distribution of POS terminals between 2015 and 2019, which saw the total number growing by a CAGR of 4.1%.

In 2018, the HKMA rolled out the Faster Payment System (FPS). This payment financial infrastructure enables 24/7 instant payments across all payment channels, including cards and digital payments. Before the FPS’ launch, bank transfers between different banks were time-consuming and expensive.

More recently, in 2021, the Hong Kong government rolled out a HK$36 billion e-voucher scheme to stimulate consumer spending during Covid-19. The first batch of HK$5,000 e-vouchers was funneled through four major digital payment operators: Octopus, AlipayHK, WeChat Pay HK, and Tap&Go.

To boost adoption, the HKMA announced the Common QR Code Standard for retail payments with a free mobile app, the Hong Kong Common QR Code (HKQR). This enabled merchants, small and medium businesses, and the public to accept payments in a single code.

With each platform having its own separate perks, Hong Kongers were effectively encouraged to use digital payments. From just the first phase of this e-voucher scheme alone, digital payment usage in Hong Kong soared, with at least 2.2 million new accounts created on Octopus, AlipayHK, WeChat Pay HK, and Tap&Go.

The e-voucher scheme continued with the second phase in 2022, distributing HK$10,000 in e-vouchers to 6.6 million eligible Hong Kongers in two stages. With the government leveraging various channels to encourage the use of digital payments in Hong Kong, it’s clear that cashless is the way forward.

Cross-border transactions spur digital shift

Close economic and trade ties with mainland China will likely hasten Hong Kong’s transition to digital payments. Recently, Chinese private banks Zhongguancun and NewUp completely terminated cash services, further propelling China towards being fully cashless. China has also announced plans to expand its digital currency e-CNY nationwide and proposed the launch of a pilot scheme in Hong Kong.

In 2023, the HKMA began working on a bilateral scheme with the Central Bank of Thailand to enable interoperability between Hong Kong’s FPS and Thailand’s PromptPay, allowing e-payment across borders.

Digital wallets

According to GlobalData, mobile wallets are set to surpass traditional payment methods as the preferred way to pay in Hong Kong and are predicted to reach $30 billion in transaction volume by 2027.

Digital wallets appeal to Hong Kongers for two key reasons: their convenience and the incentives pegged to them. Given Hong Kong’s high mobile phone penetration, it’s only natural for Hong Kongers to set up payments on their phones.

The Hong Kong government further encouraged the use of digital wallets with the Hong Kong Consumption Voucher Scheme (CVS) to stimulate consumer spending. The number of digital payment users in Hong Kong grew by at least 2.2 million across Octopus, AlipayHK, WeChat Pay HK, and Tap&Go.

Below are Hong Kong’s top digital wallets based on user adoption as of May 2020:

- Alipay: 67%

- PayMe: 64%

- WeChat Pay: 43%

- OlePay: 32%

- Apple Pay: 29%

Digital wallets are expected to become the top preferred payment method in Hong Kong by 2023, surpassing even cards and cash.

Digital payments are evolving fast in Hong Kong

With its advances in finance and technology, Hong Kong will only continue strengthening its digital payment capabilities - especially with the government’s proactive involvement with initiatives to encourage digital payment adoption and improve financial infrastructure.

While cash will continue to be a significant payment method in Hong Kong in light of local cultural practices, Hong Kong consumers increasingly prefer cashless payments.

Read more on Popular Payment Methods

Learn more about the top payment methods around the world. Check out the other articles in our Popular Payment Methods series:

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 400 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 600,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further in Hong Kong? Our friendly team is ready to help - talk to us today.