Popular Payment Methods in Indonesia: What Consumers Want

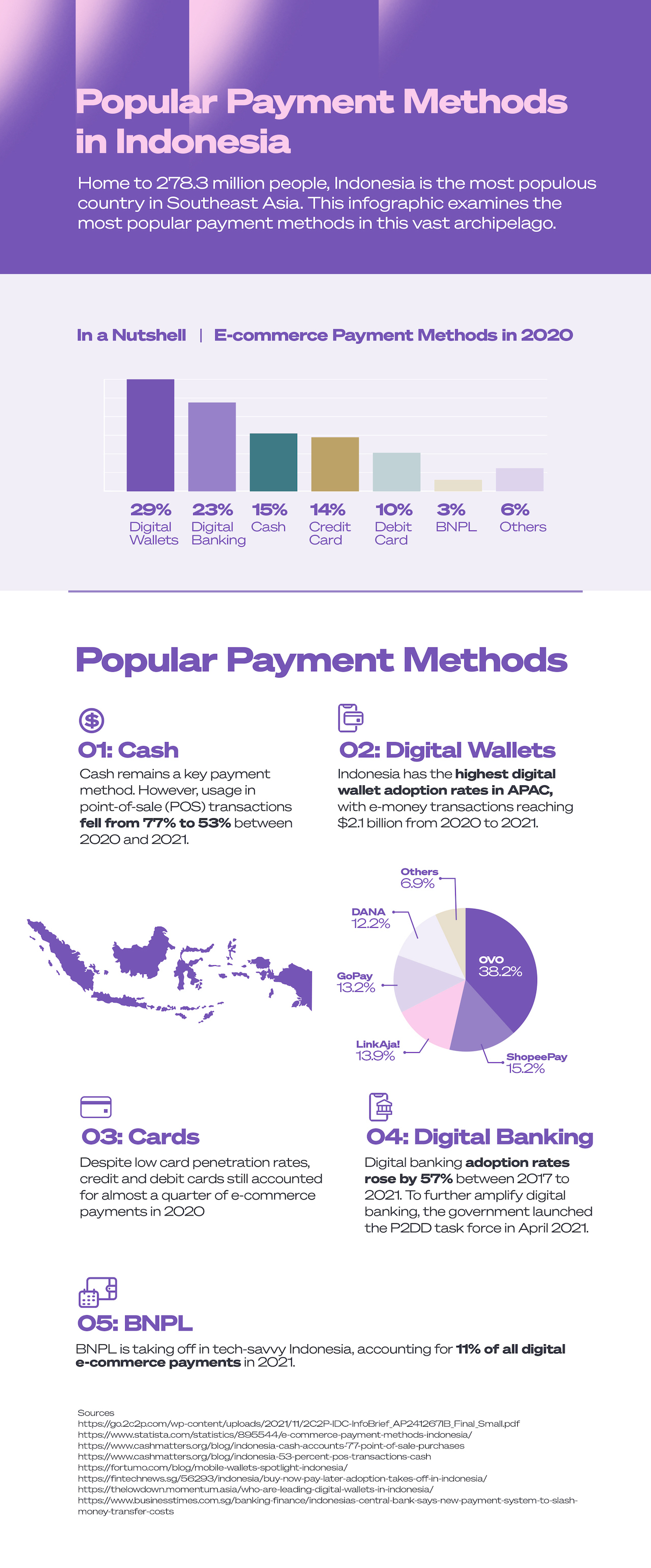

With a population size of 278.3 million, Indonesia is the most populous country in Southeast Asia. Similar to its neighbour, the Philippines, Indonesia is traditionally cash-heavy. But in more recent times, there has been a significant shift towards digital payments.

From 2020 to 2021, Cash Matters notes that the use of cash in point-of-sale transactions in Indonesia dropped from 77% to 53%. Looking ahead, cash will continue to be phased out in Indonesia. The IDC Infobrief commissioned by 2C2P highlights this development, where traditional payment methods like cash-on-delivery are projected to decline from 16% in 2019 to 6% by 2025.

The digitalisation of Indonesia’s payments landscape is certain. In this article, we will explore Indonesia’s most popular payment methods, summarised as follows:

- Cash, but digital is the way forward

- Cards

- Digital wallets

- Digital banking

- Buy Now, Pay Later (BNPL)

Cash, but digital is the way forward

As previously mentioned, the use of cash in point-of-sale transactions in Indonesia experienced a decline from 77% in 2020 to 53% in 2021. 53% is no small figure, indicating that cash continues to endure as one of the payment methods preferred by Indonesians today.

This strong preference for paper money is primarily attributed to Indonesia’s unbanked population of 181 million (at least 66% of Indonesia’s total population), making cash necessary to pay and be paid around the country.

The Indonesian government’s intervention

However, change is underway. It began with the government tapping on the country’s 202.6 million Internet users by introducing the Quick Response Code Indonesia Standard (QRIS).

The QRIS served to accelerate the development of Indonesia’s digital payments landscape by pulling together the services of all digital payment providers - mobile wallets, digital banking, and all - under one central QR code.

With the QRIS, merchants only needed to put up one QR code to accept all payment methods. Consumers had the freedom to pay with any method of their choice. The QRIS proved to be a success at launch, adopted by 3.08 million merchants in the first quarter of 2020.

COVID-19’s entry into Indonesia further accelerated the uptake of the QRIS, with 10.45 million merchants recorded to be using the system by September 2021. According to Filianingsih Hendarta, Head of Bank Indonesia’s Payment System Policy Department, this number was just shy of the targeted 12 million merchants.

The involvement of financial institutions (FIs)

To complement the Indonesian government’s measures, 72% of local FIs pledged to focus on the country’s unbanked population in 2021. To this end, FIs have been acquiring or forming partnerships with local peer-to-peer (P2P) Indonesian lenders. Traditionally, these P2P lenders maintained close working relationships with the unbanked and underbanked by channelling loans to these populations.

In 2020 and 2021 alone, Sea Ltd. purchased PT Bank Kesejahteraan Ekonomi, while Gojek spent $160 million to boost its share of PT Bank Jago.

Indonesia’s big banks have not been resting on their laurels either, with Bank Mandiri, Bank Negara Indonesia (BNI), Bank Rakyat Indonesia (BRI) and Bank Central Asia (BCA) partnering with major P2P lenders such as KoinWorks, Amartha, Modalku, Investree and Modal Rakyat in 2021.

With so many major players and stakeholders working together to accelerate digital payments in Indonesia, the use of cash will only continue to be on the decline in the future.

Digital wallets

Digital wallets take the lead as the most popular digital payment method adopted in Indonesia. According to Bank Indonesia, the volume of e-money transactions increased by 62% between 2020 and 2021 to reach $2.1 billion. This made Indonesia, along with China and India, one of the countries with the highest digital wallet adoption rates in Asia-Pacific (APAC).

Digital wallets will continue tracking strong growth in the near future; their percentage proportion of Indonesia’s gross transaction value (GTV) is projected to jump from 23% to 28% from 2019 to 2022.

COVID-19 also had a strong hand in driving digital wallet adoption in Indonesia. One local digital wallet provider DANA reported its user count doubling from 40 million to 80 million between 2019 and 2021.

As DANA CEO Vince Iswara shared with Channel News Asia,

“The pandemic has brought massive changes to the rise of digital payment. Digital payment has become an inevitable option for people to transact as it offers a possibility to avoid the risk of face-to-face payment.”

Generally, digital wallets can be split into two broad categories: independent and embedded within a larger super app. According to The Low Down by Momentum, below are the leading digital wallets in Indonesia by category in 2021:

Top Independent Digital Wallets

- OVO: 20.8 million monthly active users

- DANA: 13.5 million monthly active users

- LinkAja!: 7.2 million monthly active users

Top Embedded Digital Wallets

- ShopeePay: 51.5 million monthly active users (embedded within Shopee super app)

- GoPay: >38 million monthly active users (embedded within GoJek super app)

With exciting mergers formed between GoJek and Tokopedia and Grab and OVO in 2021 alone, the future looks bright for digital wallets in Indonesia.

Cards

Although Indonesia has a low card penetration of just 0.06 credit cards per capita and 0.64 debit cards per capita, active card usage in the country has always been consistently high, at one point dominating the online e-commerce market at 34% in 2019.

Due to COVID-19, however, the volume of credit card transactions in Indonesia fell from $268.21 million in 2020 to $87.82 million in 2021. Despite this decline, credit cards were a key e-commerce payment method in 2020, accounting for 14% of the total distribution. Debit cards did not fall too far behind at 10%.

Despite this decline, cards will continue to be a preferred payment method in Indonesia. Our IDC Infobrief reflects this fact, with the percentage proportion of GTV expected to fall from 30% in 2019 to 28% in 2025.

Digital banking

Digital banking is beginning to make significant headway in Indonesia. From 2017 to 2021, digital banking adoption rates increased by a massive 57% - this means that at least 78% of Indonesian customers actively use digital banking services today.

As much as digital wallets are well-loved for their ease and convenience, they come with limitations. Digital banking can fill this gap with a suite of services, including loans, credit card applications, and trading.

The government recognises the importance of developing digital banking in Indonesia and launched the Task Force for the Acceleration and Expansion of Regional Digitalisation (P2DD) in April 2021.

One of the task force’s main objectives is integrating the national digital economy with financial institutions like banks. That’s why new regulations were introduced to allow near-full foreign ownership of local lenders - foreign companies can now hold up to 99% in a local lender.

With digital banking receiving support from the government, it will continue to grow exponentially well into the future.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) is relatively new in Indonesia, allowing consumers to break up larger purchases into bite-sized, palatable monthly instalments. By 2021, BNPL has begun to take off in Indonesia, accounting for 11% of all digital payments used on e-commerce.

According to Fintech News, Indonesian BNPL users are generally satisfied with the system. In particular, they appreciate the seamless transaction experience, easy application prerequisites, and speedy approval process.

Given the healthy outlook towards BNPL, it will continue to grow and develop well into the future. Our IDC Infobrief projects that its Gross Merchandise Value (GMV) percentage proportion will steadily increase from 1% in 2019 to 6% in 2025.

The Indonesia Paylater Ecosystem Report 2021 takes this projection even further, expecting the GMV of BNPL to increase by 75.7% from $889.7 million in 2020 to $8.5 billion by 2028.

Read more on Popular Payment Methods

Learn more about the top payment methods around the world. Check out the other articles in our Popular Payment Methods series:

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 250 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 400,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further in Indonesia? Our friendly team is ready to help - talk to us today.