Popular Payment Methods in Malaysia: What Consumers Want

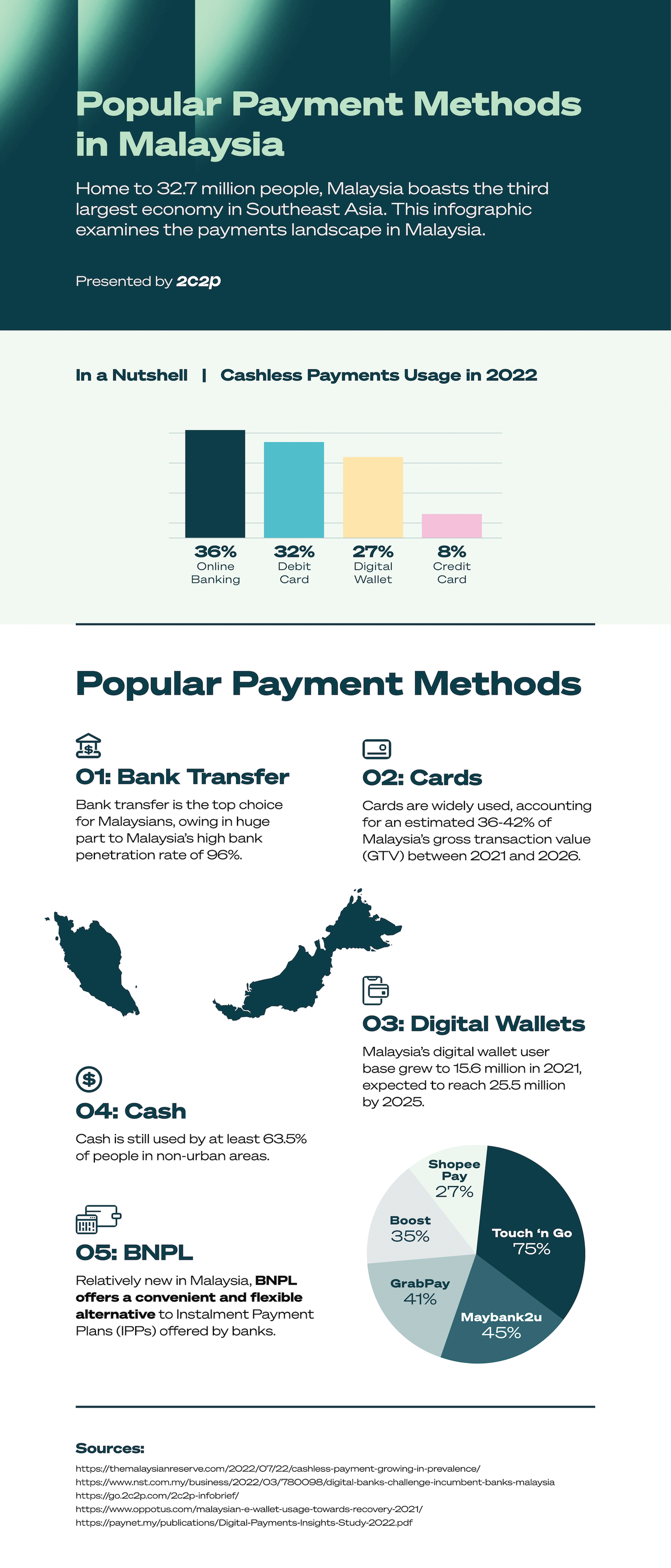

Home to 32.7 million people, Malaysia boasts the third-largest economy in Southeast Asia, with a GDP of US$439.37 billion. Digital payments are favoured in internet-savvy Malaysia, whose internet penetration rate is 90.2%.

Given widespread government initiatives encouraging the use of cashless payment methods like cards and digital wallets, Malaysia’s adoption of digital payments is not unprecedented.

According to a joint study between IDC and Malaysia Digital Economy Corporation (MDEC) on Malaysia’s digital payments market, the gross transaction value (GTV) of the country’s ecommerce sector is projected to reach US$6 billion in 2022. This figure is expected to expand to US$13 billion by 2025.

In this article, we will explore the most popular payment methods in Malaysia, summarised as follows:

- Bank transfer

- Cards

- Digital wallets

- Cash

- Buy Now, Pay Later (BNPL)

Bank transfer

Bank transfer stands as the most popular payment method in Malaysia, owing in huge part to the country’s high bank penetration rate - as of 2022, this sits at a comfortable 96%.

Digital banking has also taken off in Malaysia; 90% of consumers used online banking services at least once per month in 2021 compared to 62% in 2017. These services are housed in apps accessible on mobile phones, enabling consumers to make seamless bank transfers anytime, anywhere.

Below are the top mobile banking apps used by Malaysians:

Financial Process Exchange (FPX)

The popularity of bank transfers in Malaysia ultimately boils down to the country’s secure payment system, Financial Process Exchange (FPX). Operated by Bank Negara Malaysia’s Payments Network Sdn Bhd (PayNet), FPX is designed to be both safe and convenient for consumers.

FPX has gone a long way to building consumers’ trust in bank transfers, allowing them to securely complete their transactions online with their bank credentials in minutes. FPX has also formed partnerships with most of Malaysia’s banks, making it an all-encompassing system that serves all Malaysians regardless of which bank(s) they work with.

DuitNow

To further facilitate bank transfers across Malaysia, PayNet collaborated with the country’s major banks to launch DuitNow in 2018. DuitNow is a real-time payments platform that enables Malaysians to send money instantly and securely with their mobile phone or national ID number. The platform is available 24/7, offering Malaysians a greater breadth of convenience to transfer funds.

DuitNow was later augmented with Quick Response (QR) functionality in 2019. Established by PayNet, DuitNow QR was set up to serve as Malaysia’s national QR standard. As of 2021, DuitNow QR has begun consolidating all existing QR payment codes under one central QR code, further facilitating fast, seamless payments in physical stores.

DuitNow further amplified the growth of bank transfers in Malaysia, with Bank Negara Malaysia recording a 59.4% increase in merchant registrations for DuitNow QR in 2021. By the end of end-2021, the total number of merchant registrations for DuitNow QR stood at 1.1 million.

Cards

Card usage is widespread in Malaysia, with GlobalData noting that the value of card payments in the country attained a strong growth of 15.9% in 2021. This figure is expected to remain consistent, with a robust growth rate of 15.2% by the end of 2022.

According to 2C2P and MRC’s commissioned report with IDC, card usage in Malaysia is expected to remain consistently high between 2021 and 2026, accounting for 36-42% of the country’s ecommerce gross transaction value (GTV).

The enduring growth of card payments in Malaysia is fueled by three main factors: a gradual increase in consumer spending, the government’s financial inclusion policies, and an overall preference for contactless payments.

Covid-19 played a key role in encouraging the use of contactless cards, as consumers sought a safer way to pay for their purchases at physical stores. In 2021, Bank Negara Malaysia noted that two out of every three card payments at physical stores were contactless - a significant increase from one out of two in 2020.

Digital wallets

While cards and bank transfers serve as Malaysia’s top preferred payment methods, digital wallets have also been making their mark in the country. According to a Statista survey on digital payments, the share of respondents who used digital wallets soared from 15% in Q1 2019 to 68% in Q1 2022.

According to 2C2P and MRC’s commissioned report with IDC, the mobile wallet user base reached 15.6 million in 2021. Mobile wallet usage will only continue to grow in the years to come, with the user base expected to reach 25.5 million by 2025.

Below are the top digital wallets used in Malaysia in Q3 2021, according to usage among survey respondents:

- Touch n' Go: 75%

- MAE by Maybank2u: 45%

- GrabPay: 41%

- Boost: 35%

- ShopeePay: 27%

Of these wallets, Touch ‘n Go stands out for having begun as a stored-value card that Malaysians use to pay for highway tolls. It was not until 2017 that Touch ‘n Go partnered with Ant Financial to launch its digital wallet product.

Cash

Although cash usage is not as widespread in Malaysia today, PayNet noted that at least 48.4% of Malaysians continue to use cash for daily expenses in its Digital Payments Insights Study 2022.

PayNet notes that cash usage is especially prevalent in non-urban areas, where at least 63.5% of the population still uses cash for payments. In urban areas, however, just 36.2% of the population pay with cash.

Buy Now, Pay Later (BNPL)

BNPL has skyrocketed in popularity recently, and Malaysia is no exception. According to 2C2P and MRC’s commissioned report with IDC, Malaysia recorded US$0.2 billion of BNPL transaction volume in 2021. This figure is expected to expand by 3.5 times to reach US$0.9 billion by 2026.

Similar to other countries worldwide, BNPL is especially favoured by younger generations of Malaysians, who appreciate the interest-free, cardless nature of the service.

Key BNPL players in Malaysia include Atome, FavePay Later, ShopBack Pay Later (formerly hoolah), and Mr Pay Later.

Digital payments are king in Malaysia

Malaysians are highly receptive to digital payments, consistently choosing cashless options to pay for their purchases. While Covid-19 had a massive hand in influencing this preference, the digital-savvy nature of Malaysia’s population has played a much more significant role.

Looking ahead, digital payments will continue to grow apace in Malaysia. Given the combined efforts of the government and the people, we can see cash continue to be phased out.

Read more on Popular Payment Methods

Learn more about the top payment methods around the world. Check out the other articles in our Popular Payment Methods series:

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 250 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 400,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further in Malaysia? Our friendly team is ready to help - talk to us today.