Credit Card Payment Processing Explained: Acquirers vs. Issuers

How do credit card transactions work? What are acquirers, issuers, and third party providers, and what roles do they play in the payment processing flow?

In this article, we explore how card payments are processed and the different parties involved.

In 2022, total global credit card transactions amounted to an average of 1.86 billion per day. For consumers, each transaction is a matter of seconds, with a simple tap of the card at a POS terminal or keying in their card details to make a purchase online. But behind the scenes, a sophisticated process takes place with every payment that is initiated. Beyond the customer and the merchant, acquirers and issuers play a key role in facilitating the seamless execution of every transaction.

In this article, we’ll explore the following:

- What are acquirers?

- What are issuers?

- The difference between acquirers and issuers

- How payment processing works

- What is 2C2P's role?

- Benefits of partnering with a third-party payment processor or facilitator

- Choosing a third-party payment processor or facilitator

Acquirers vs Issuers: What businesses need to know

What are acquirers?

Acquirers, also known as card acquirers or acquiring banks, refer to financial institutions that enable businesses to accept credit card payments. They act as intermediaries, enabling communication between banks and merchants.

For instance, when a customer submits their payment card details to make a purchase online, the acquirer takes the payment details from customers and routes them through card networks like Visa, Mastercard, or American Express to the issuing bank. After the transaction is authorised, the acquirer routes the funds provided by the issuing bank to the merchant’s account. It is also common for acquirers to work with third-party payment processors to process these transactions.

Acquirers are usually a bank, a fintech company, or other financial institutions. To conduct operations, they must be licensed by local and/or global financial regulators and card schemes. This licence is obtained through a long and complex administrative process, which involves compliance with financial institution regulatory requirements, as well as card scheme requirements. Acquirers are responsible for implementing security standards that meet the requirements of the Payment Card Industry Data Security Standards (PCI DSS) Council to prevent data breaches during a transaction.

What are issuers?

Issuers, also known as card issuers or issuing banks, represent the consumer side of things. They are the financial institutions, typically banks, that provide customers with the credit or debit cards that they use to pay.

When a consumer purchases something, the issuer approves the transaction, deducts the money from your account, and sends it on its way to the merchant. Outside of a transaction, issuers assess an individual’s creditworthiness based on factors such as credit score and financial history to issue credit. If an issuer approves a customer, they issue a card that allows the customer access to a line of credit. These lines of credit refer to the loans granted to the cardholder. In the event that the cardholder is unable to repay their loan and defaults, the issuer becomes liable for the debt and has to take care of the initial transaction.

What’s the difference between acquirers and issuers?

Here's the crux: Acquirers handle the merchant's side of the equation, maintaining their accounts and facilitating the transfer of funds from cardholders into a business's coffers. They also keep transaction records and relay authorisation requests to card networks. Issuers, on the other hand, maintain the debit or credit accounts of a cardholder, offering credit or funds that can be used to make payments through a card transaction.

How credit card payment processing works

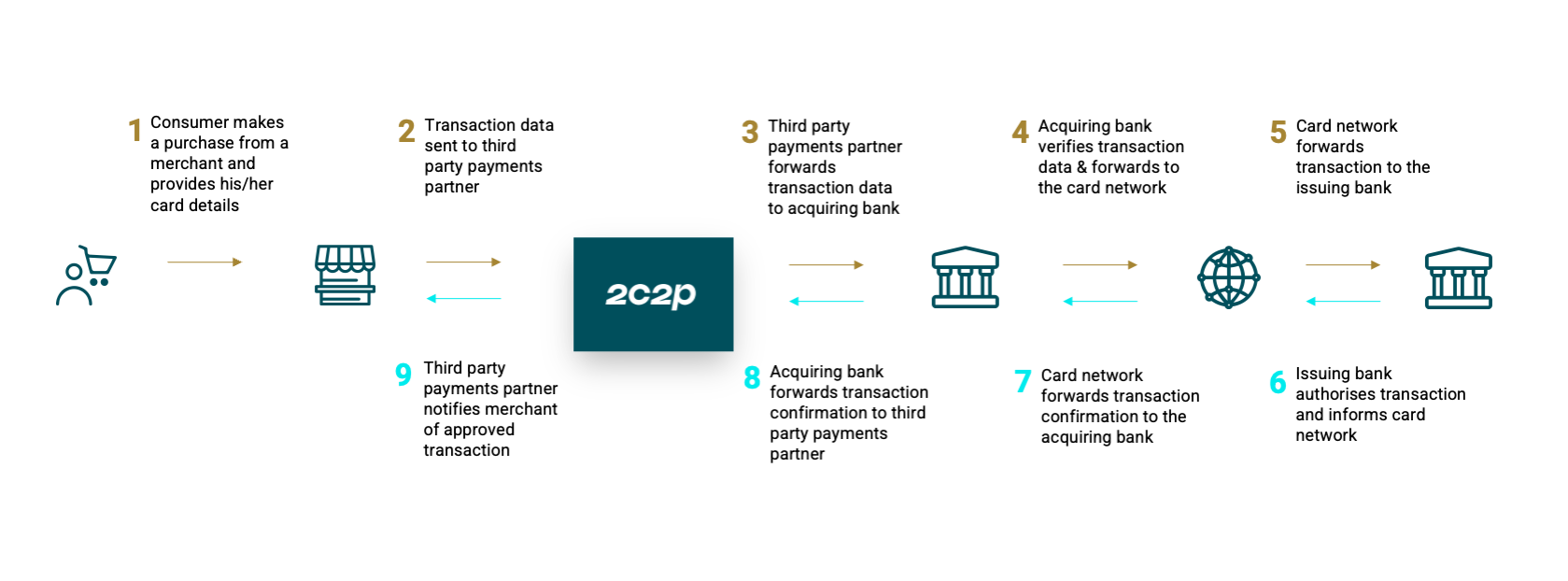

Here’s the end-to-end process that goes behind every card payment:

- Every payment starts with the cardholder initiating a purchase from a merchant, either online or offline.

- Through a payment processing service or device, the merchant forwards the transaction information to the acquiring bank for authorisation.

- The acquirer proceeds to verify the cardholder before submitting the transaction details to the card network.

- The card network then forwards the transaction to the issuing bank, which will check if there are sufficient funds available in the cardholder’s account.

- If so, the issuing bank will authorise the transaction and send confirmation back to both the merchant and the acquiring bank through the card network.

What is 2C2P's role?

Navigating payment ecosystems has become increasingly complex for businesses, demanding constant adaptation to consumer preferences and the ever-evolving payments terrain. Amidst the complexity, various third-party solutions offer relief, with two main types being payment processors and Payment Facilitators (PayFacs).

A traditional third-party payment processor functions as an intermediary, managing digital transactions and orchestrating the entire process, from customer initiation to fund transfer into the business's bank account. This involves crucial steps like authentication, transaction security, approval confirmation and notification to the business.

On the other hand, the PayFac model simplifies the payment processes for businesses by streamlining onboarding procedures, eliminating the need for individual merchant accounts. PayFacs manage the underwriting, risk assessment, fund settlement and regulatory compliance, empowering businesses to focus on their core operations without being burdened by complex payment intricacies.

The beauty of 2C2P’s comprehensive platform is that it offers both payment processor and PayFac models in key markets. This means businesses can use 2C2P as an external payment acceptance and management provider, or opt for a more hands-off, hassle-free approach by letting 2C2P handle the merchant account functionality process.

Benefits of partnering with a PayFac and payment processor provider

With the growing number of digital payment methods and customer expectations for rapid, secure payments, businesses must choose the right payments provider to streamline payments. Using a full suite payments platform like 2C2P, which offers both the payment processor and PayFac models, has many key benefits:

Remove complexities

As a full suite payments provider boasting over two decades of industry expertise, 2C2P stands out as an invaluable consultant for businesses, offering unparalleled guidance. For instance, they consolidate Merchant ID (MID) requests, perform comprehensive Know Your Customer (KYC) checks and seamlessly connect you with acquirers to meet your precise requirements.

Fees

2C2P provides cost-effective solutions featuring flat transaction fees. Unlike the varied fees linked to merchant accounts, their straightforward pricing structure benefits businesses by ensuring transparency and predictability in transaction costs.

Consolidated reporting and reconciliation

Full suite payments providers such as 2C2P assist companies in consolidating transactions, settlements and providing comprehensive reporting. This significantly enhances financial visibility and simplifies reconciliation processes for businesses.

Payment flexibility

2C2P empowers merchants with unrivalled payment flexibility, enabling acceptance of a wide array of payment methods. From traditional cards to the latest alternative payment methods (APMs) like mobile wallets and Buy Now Pay Later (BNPL), 2C2P ensures businesses cater to diverse customer preferences.

In essence, 2C2P's role as a PayFac and payment processor transcends mere transaction facilitation. It offers efficiency, cost-effectiveness and adaptability in the dynamic realm of online payments. This comprehensive approach caters to merchants seeking scalable solutions to expand their business.

Choosing a third-party payment processor or facilitator

Payments are the core of every business, and ensuring a seamless checkout process for customers is imperative. Opting for the right third-party payment processor or facilitator can streamline payment processes, potentially amplifying your success, especially when expanding your business into new markets.

Evaluate your business needs

Assessing your business requirements is crucial when choosing the ideal payments partner. Consider elements such as your average sales volume, typical transaction sizes, the nature of your products or services, and your customers' preferred payment methods. These factors are pivotal in identifying your business's most fitting payments solution.

Understand your customers

Know where your customers are at. Preferences can significantly vary based on geographic location. For instance, bank transfers reign as one of the most popular payment methods in Thailand, whereas cards dominate as the most popular payment method in Singapore. Understanding these regional differences is key to catering effectively to your customer base.

Security, reliability, and scalability

As payment fraud becomes more sophisticated, prioritising security measures is paramount when choosing a payments facilitator. Look for partners well-versed in the specifics of your target region, capable of swiftly adapting their payment solutions to evolving landscapes. They should possess extensive insights into global developments, integrating these into their technology roadmap.

Reliability is crucial—research the third-party's service track record and frequency of downtime. Moreover, align your long-term objectives: opt for a partner equipped to scale alongside your business, seamlessly managing heightened transaction volumes as your needs expand.

About 2C2P

In the ever-evolving landscape of payments, 2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels and providing issuing, payout, remittance and digital goods services.

With over 400 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 600,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

One of our core offerings is our role as a payment facilitator. With over two decades of expertise in Asia, we act as a trusted consultant with deep industry knowledge that guides you through the intricacies of payments processing, enabling businesses to focus on growth.

Want to take your business further? Tap on our extensive experience and network in the region to better navigate regulatory complexities and create an optimal domestic and cross-border payment experience. Our friendly team is ready to help - talk to us today.