Payments Powerhouses: Providing Inclusive Financial Services in Indonesia

Payments Powerhouses is a monthly series featuring trailblazers on Southeast Asia’s fintech scene. In the fifth instalment of the series, we speak with Rangga Wiseno, who has devoted his life to solving problems in design, engineering and business, whether for multinational companies or local startup unicorns.

Rangga is currently Senior VP of Product at DANA, an Indonesian fintech, where he leads development of digital wallets. DANA’s digital wallet is a standout product that has amassed over 70 million users and swept awards praising its usability and features.

Before joining DANA, he cut his teeth in developing mobile applications and leading teams during his times at software developer Ice House and creative-incubator Digital Buana.

He holds a Bachelor’s Degree in Information Technology and a Master’s Degree in Information System Management from Binus University.

Hi Rangga! Can you explain to our audience what you do at DANA?

Rangga Wiseno: I'm the Senior Vice President of product in DANA, directly reporting to the CEO, and I manage over 40 to 50 team members, consisting of product managers.

Our goal is mainly to solve the customers' problem. How we solve that is basically by understanding their problems and then bridging it with our technology.

The second dimension is stack. We create solutions, not only just by putting a tech stack on top of it, but we also think about how we can be optimising and using the tech, like machine learning.

The third dimension is about the business itself. We discuss with the business development team or partnership team to see the model that makes sense.

Can you explain what DANA provides to Indonesia? What's the product?

We want to become a bridge for the unbanked, which is more than 50% of the population in Indonesia. We provide inclusive financial services, starting from payments. We provide additional services like pay later and investments. We also provide products for them to set their financial goals.

What was your journey like, prior to joining DANA?

Before joining DANA, I was at Ice House, basically a development centre specialised in mobile development. People came to us to ask us to build mobile apps and we did projects for them. Afterwards I met Vince and joined DANA as part of the founding team.

What makes DANA so unique or stand out from its competitors?

There are three guiding principles that we set internally, which are 'trusted', 'friendly', and 'accessible'. The most important one is that we are open or 'accessible'. Some or most of the other e-wallets play the walled garden strategy.

We started in BBM – BlackBerry Messenger. We had kickstarted our development through Bukalapak and also TIX.ID. We provided the infrastructure for these merchants who have their own use cases. We then started to think how we could provide this end-to-end payment experience to them.

Later on, we had a big vision. Not only is BBM declining, but we see that P2P transfer is an important battle for us. That's why we set up our own standalone app. But it's an open ecosystem where we collaborate with different parties from the start.

The second principle is about 'friendly'. We always focus on the user experience. For example, how can we provide a seamless experience for the KYC process? I think we're the ones who started with the automation of KYC using facial recognition.

The third one is we try to keep it 'trusted'. Digital financial adoption is still relatively low in Indonesia, even though the trend is rising during this pandemic. Thus becoming a trusted digital wallet means a lot to Indonesians. We’re gaining their trust by becoming a smart digital wallet – balancing between the simple and the secure. Sometimes, more security might mean a more rigid experience, but we try to get this balance.

It seems like there are quite a lot of use cases in DANA. Who is DANA's main target audience?

When it comes to payment adoptions, there are two kinds of persona that we see. One is the early adopters. In Indonesia, it's the middle class - they are technologically-savvy and live in urban areas - basically young people who not only have the ability but the knowledge to adopt a digital service easily.

The second one is the late adopters. Between these two, we always keep it balanced, but we see a wave coming in from Gen Z, where they start to become aware of the ease of Digital Payments and become savvier in managing their financial health.

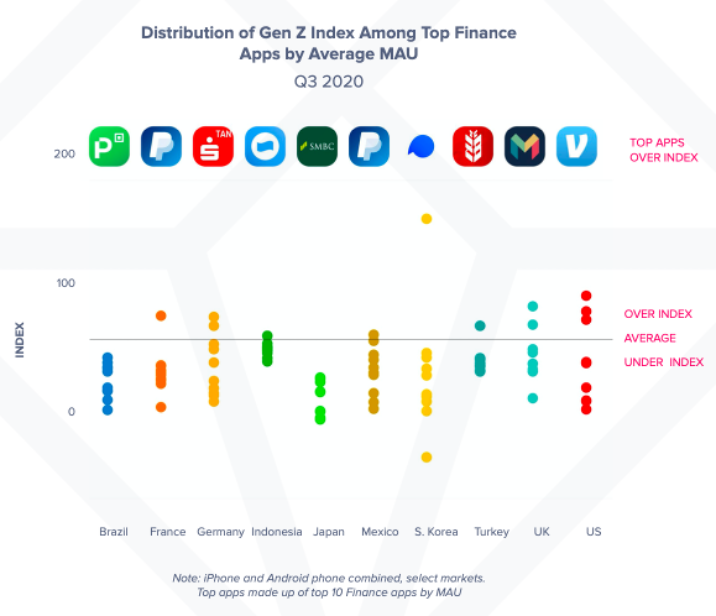

Source: “How to build winning Gen. Z Strategy” – AppAnnie Research (Q3-2020)

This trend also aligned with the latest research from AppAnnie, where we lead the Gen-Z adoption index amongst Top Finance Apps by Average MAU for the Indonesian market.

What are the features on DANA that are more popularly used by each of these demographics?

That's a very good question. So, right now, for the early adopters in e-wallets, we've seen that there are six big use cases. One is online payments related to e-commerce. The second one is offline payments, directly paying at the stores. Third one is P2P transfer. Fourth one is basically bill payments. The fifth one is food delivery and ride hailing and the sixth is transportation.

However with the recent pandemic, we saw that consumers started to shift from Offline spaces to Online ones.

Source: DANA Press Release (June 2021)

Can you explain to us what Indonesia's payments landscape was like 5 years ago, or 10 years ago, versus now? And the context that DANA operates in?

Maybe I'll start with 2019 because that was the most interesting year. The offline payment scene was booming. You could see that many digital wallets at that time set up cashback promos from 30% off to up to 50% off but we were crazier than them, so we set a 100% cashback promo. This strategy was good back then, because all the players were helping each other to educate consumers and to encourage them to move away from cash.

However, after the education period was over, we needed to ensure that we could still retain our consumers because of our value and not the incentives. So, we strengthened our core of being Accessible, Friendly, and Trusted, while also continuously educating the consumers through DANA's various channels – ensuring the improvement of their digital financial literacy.

This strategy was also stimulated with a few factors that changed the landscape in 2020. One is the pandemic itself, which meant that more people were adopting Digital Payments. Second is QRIS (Quick Response Code Indonesia Standard). The Bank of Indonesia said, "Hey, if you already have a QR code, you need to apply the same standard." As a result, right now, DANA's QR code can be scanned by other digital wallets and, likewise, other wallets' QR code can be scanned by DANA. That changed the competitive landscape of offline businesses.

So, it's like a levelled playing field?

QRIS is an opportunity that, like you say, levels the playing field for new entrants. We have new players that didn't engage in 2019. One is Shopee. They really focused on acquiring the offline, utilising QRIS and providing incentives for users.

Now, we not only want to educate about DANA QR or Ovo QR, we want to educate on QRIS QR to support the whole open payments ecosystem. We’ve shifted our focus from deeper development or product development more into those additional use cases, like P2P, online payments and bill payments.

The latest news that will change the payments landscape is the merger between the big two unicorns: Gojek and Tokopedia.

There are lots of small street vendors in Indonesia. Are they a use case for DANA and will people start to pay with digital wallets to pay these vendors?

Yeah. We want to become a bridge not only for big business, which is what we call key accounts, but also for micro businesses.

We are building our self-service for the micro merchants to adopt by themselves. Around 2020, we launched DANA Business. It's a product for micro merchants to register from our app, and accept QR payments and all the other merchants' use cases. So that effect came in line when our users grew bigger. Right now, we already have 70 million users.

What in your view would be a kind of upcoming trend that will take shape in the payments space?

We see the wave of loan businesses in Indonesia booming. We see that banks are also becoming more digital. And we see retail investors coming in to back mini investment startups.

So, the ecosystem is expanding from payments to these two types next: loans and investments mostly. That's the next trend.

To wrap up, please share some fun facts about yourself! What is your favourite product or app of all time, and you can't say DANA.

I would say Medium, where you read articles. It's part of my daily habit where I can gain more knowledge. Typically, I read articles for products, transport, designs, engineering. So it's a very useful app.

What is your favourite food?

My favourite food is noodles. Indomie actually. It's like my comfort food, especially if you eat it while it is raining.

Last question, how do you like to spend your free time?

When I'm free, I love to listen to podcasts. So that's my routine. And then the second one, it's basically reading, reading Medium. And the third one, if there are some very good series on Netflix, I will do some binge watching in my free time.

. . .

Payments Powerhouses is a monthly editorial series interviewing the movers and shakers of the payments and wider fintech industry, in Southeast Asia and beyond. If you’d like to be featured on Payments Powerhouses, reach out to us here.