Popular Payment Methods in the Philippines: What Consumers Want

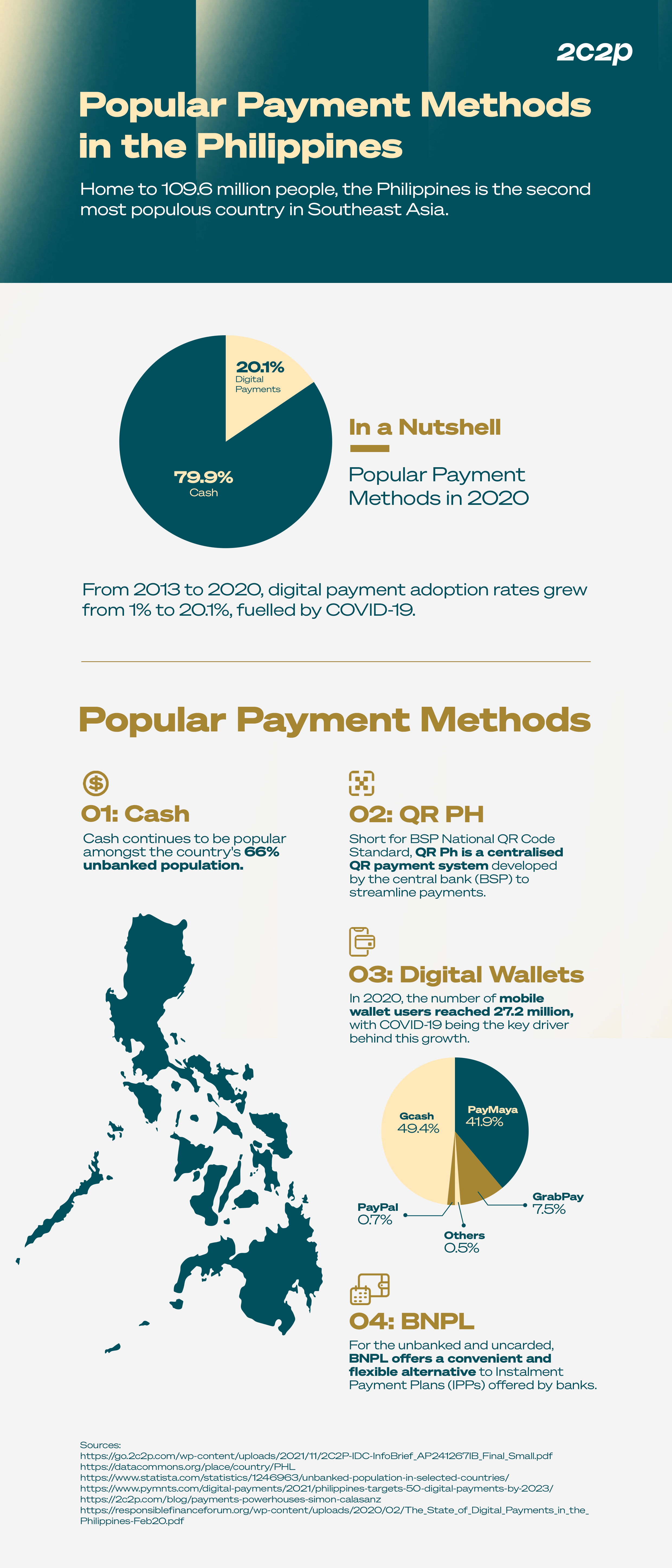

Home to 109.6 million people, the Philippines has the second largest population in Southeast Asia. In spite of the Covid-19 pandemic, the nation’s economy expanded strongly in 2021 and its GDP growth rate is forecast to climb further to reach 7.9% in 2022.

Traditionally a cash-heavy nation due to a population of 66% unbanked users, the Philippines has made great strides in the digital transformation of its payments landscape.

From 2013 to 2020, digital payment adoption rates grew from 1% to 20.1%. COVID-19 was a major influencing factor, as many Filipinos opted to make transactions from the safety of their homes - between 2019 and 2020, online payment adoption spiked from 14% to 20.1%.

Given the rapid growth of digital payments in the Philippines, Bangko Sentral ng Pilipinas (BSP), the Philippines’ central bank, is optimistic that the country is well on its way to hitting its target of digital payments comprising 50% of its retail volume by 2023.

This article will examine the Philippines’ most popular payment methods, which we summarise as follows:

- Cash, but the future is cash-lite

- BSP National QR Code Standard

- Digital wallets

- Buy Now, Pay Later (BNPL)

- Real-time payments

Cash, but the future is cash-lite

Cash remains the most preferred payment method in the Philippines, accounting for almost 80% of all payments made in 2020. This is primarily attributed to the Philippines’ enormous unbanked population, which has historically been difficult to migrate to digital payments.

The Philippines has yet to undergo a credit card revolution, with World Bank data indicating that just 2% of the population aged 15 and above owned credit cards in 2017.

Yet, Filipinos are tech-savvy and spend more time online than other countries, putting the country in an excellent position to migrate from cash to digital payments. Covid-19 helped accelerate the shift, pushing people towards digital payments to avoid physical contact with germ-carrying cash.

The Philippine central bank, Bangko Sentral ng Pilipinas (BSP), has been actively involved in the country’s digital payment transformation. This began with creating the National Retail Payment System (NRPS) in 2015, which launched two real-time payment systems: PESONet to replace check usage in governments and businesses, and InstaPay to replace smaller person-to-person (P2P) cash transactions.

With all these factors in mind, TendoPay co-founder and CEO Kacper Marcinkowki’s quip that the Philippines could “skip the phase of credit cards” altogether rings true, as the country certainly looks set to dive straight into new forms of digital payments instead.

This shift is reflected in our commissioned IDC InfoBrief. Between 2019 and 2025, the percentage taken up by cash in the Philippines’ Gross Transaction Value (GTV) is expected to drop from 47% to 27%. In its place, mobile wallets are projected to grow from 16% to 27%, domestic digital payments from 21% to 23%, and Buy Now, Pay Later (BNPL) from 0% to 4%.

In the following sections, we will examine some of the most popular digital payment methods used in the Philippines today.

BSP National QR Code Standard

BSP National QR Code Standard, or QRPh for short, is the BSP’s latest digital payment solution, which aims to “foster interoperability and competition to help further accelerate the growth in digital payments in the coming years.”

QR Ph’s system is affordable and straightforward, merely requiring consumers to scan a QR Ph code generated by banks and electronic money issuers to make payments.

Launched in November 2019, QR Ph was a real-time, integrated local payment method originally designed for Person-to-Person (P2P) transactions. It was later expanded for Person-to-Merchant (P2M) transactions in April 2021.

According to BSP’s Digital Payments Transformation Roadmap Report, QR Ph saw the number of P2P transactions in the Philippines almost doubling within a month of its launch, as Filipinos quickly embraced it for its ease and efficiency of use.

As for the P2M segment of QR Ph, more than 160,000 acceptance sites have been onboarded by the BSP since its launch. This figure includes large businesses and government agencies and micro, small, and medium enterprises (MSMEs) like peddlers, sari-sari (Tagalog for sundry shops) store owners, and other entrepreneurs.

Moving forward, the BSP signed a Fintech Cooperation Agreement (CA) with Singapore’s Monetary Authority of Singapore (MAS) on 8 November 2021 to integrate both countries’ real-time and QR payment systems. With this integration, cross-border payment flows between the Philippines and Singapore are instant, seamless, and affordable.

Digital wallets

In 2020, the number of mobile wallet users in the Philippines reached 27.2 million, with this figure forecasted to reach as high as 65.2 million by 2025. In turn, this explosive growth fuelled the e-commerce boom in 2020, which saw the industry growing by 11.8%, or $4.8 billion.

COVID-19 was the key driver behind this growth, with at least 52% of Filipinos shopping online for the first time due to the pandemic. The top 4 mobile wallets used by Filipinos in 2020 are as follows:

- Gcash: 49.4%

- PayMaya: 41.9%

- GrabPay: 7.5%

- PayPal: 0.7%

According to PayMaya president Shailesh Baidwan, many new digital wallet users were previously unbanked and underserved, all of whom turned to this payment method for “accessibility, safety, and convenience.”

Buy Now, Pay Later (BNPL)

With the growth of the e-commerce market came other digital payment methods in the Philippines. BNPL is one such method, although the scale of its development is currently minuscule compared to digital wallets.

In 2020, BNPL spending on e-commerce in the Philippines was just $0.05 billion. However, BNPL looks set to become increasingly popular in the nation, projected to grow by 10.4x to reach $0.57 billion in 2025.

This projection is primarily based on the Philippines’ substantial unbanked and underserved population, which neither owns credit cards nor has the necessary documentation to sign up for one. The inaccessibility of credit cards deters them from taking Instalment Payment Plans (IPPs) that banks traditionally offer.

BNPL offers a convenient and flexible alternative to IPPs, breaking up purchases into manageable bite-sized monthly instalments without the need to own a credit card. To this end, several fintech firms have set up their services in the Philippines, including our partners BillEase and TendoPay.

The future is digital for the Philippines

While the Philippines remains predominantly cash-heavy, it is clear that the country is undergoing a significant shift towards digital payments, driven by a combination of COVID-19 and governmental initiatives.

At least 88% of Filipinos who still use cash have indicated their interest in switching to digital payments. With digital payments becoming increasingly accessible and convenient, it is only a matter of time before the Philippines truly ascends from cash-lite to cashless.

Read more on Popular Payment Methods

Learn more about the top payment methods around the world. Check out the other articles in our Popular Payment Methods series:

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 250 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 400,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further in the Philippines? Our friendly team is ready to help - talk to us today.