Popular Payment Methods in Singapore: What Consumers Want

Home to 5.92 million people, Singapore is the top financial and business hub in Southeast Asia, with a GDP of over US$396 billion. The world’s fourth most digitally competitive country in 2022, Singapore’s population is tech-savvy and quick to embrace technological advancements such as digital payments.

Combined with extensive governmental efforts to transform Singapore into a digital-first country, it is unsurprising that digital payments are commonplace in Singapore. According to Statista, the total transaction value of digital payments in Singapore will reach US$20.82 billion in 2023, with an annual growth rate of 18.23% until 2027.

In this article, we will explore the most popular payment methods in Singapore, summarised as follows:

- Cards

- Bank transfers

- QR code payments

- Digital wallets

- Cash

- Buy Now, Pay Later (BNPL)

Cards

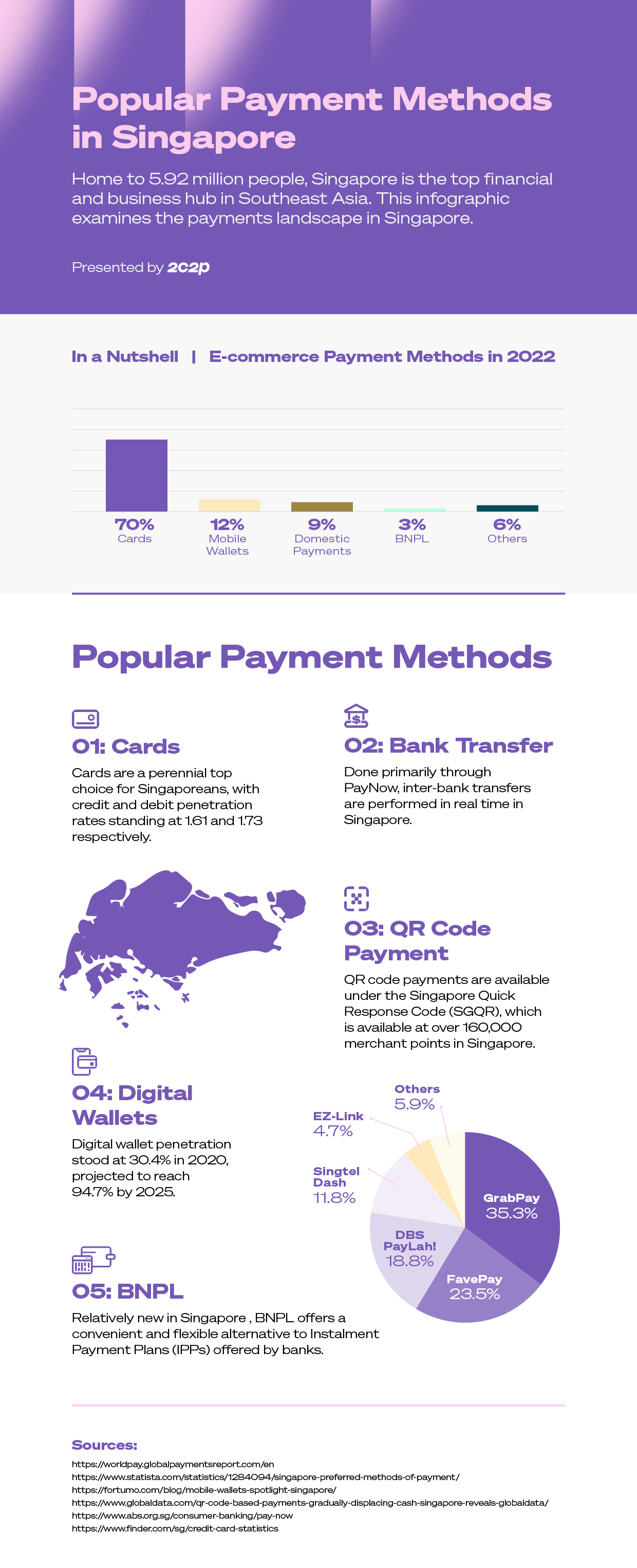

Cards are king in Singapore – a reflection of its mature economy. The Visa Consumer Payment Attitudes Study revealed that more than 95 per cent of Singapore consumers use credit or debit cards for payment, a consistent trend across generations from Baby Boomers to Gen Z.

Singapore boasts Southeast Asia’s highest card penetration rate at 1.73 debit cards and 1.61 credit cards per capita. The ready usage of cards for payments can be attributed mainly to Singapore’s highly banked population, with the Monetary Authority of Singapore (MAS) estimating that over 98% of adult Singapore residents have bank accounts.

In 2022, credit and debit cards combined took up the majority of the payment share both in e-commerce and at POS, according to the FIS Global Payments Report. Credit cards reported a 42% share of e-commerce transaction value in 2022, while debit cards had an 11% share.

Credit cards are especially popular amongst Singaporeans because they are convenient, build credit scores, earn points for rewards programmes, and even accumulate cashback and discounts. In fact, 73% of Singaporeans own at least one credit card, with 10% owning six or more.

Although credit cards often offer notable benefits over debit cards, debit cards are still widely used by Singaporeans who are wary of incurring credit debts or extra costs that can potentially result from credit card usage.

Contactless functionality boosts card usage

In Singapore, near-field communication (NFC) functionality provided by Visa payWave and Mastercard contactless augments credit and debit cards to enable consumers to make contactless payments.

With thousands of merchants accepting NFC-enabled contactless card payments across the country, Singaporeans are further motivated to pay with their cards.

Add to that the availability of mobile wallets such as Apple Pay and Google Pay. These wallets allow users to add their cards and use their smartphones to make contactless payments.

The impact that contactless functionality has on card usage is massive. In 2021, Visa’s Consumer Payment Attitudes Study found that contactless card payments were Singaporeans' most preferred payment method (31%).

COVID-19 played an enormous role in driving this preference, with Visa Country Manager for Singapore and Brunei Kunal Chatterjee noting that “the stickiness of new digital payment habits formed during the pandemic cannot be underestimated.”

According to a contactless payments survey done in 2020, nine in 10 Singaporeans said that “contactless is the cleaner way to pay”, prompting many to go contactless due to safety reasons.

Even after the pandemic, Singaporeans continue to prefer contactless methods to pay. Visa’s Consumer Payment Attitudes Study 2022 found that more than nine in ten Visa transactions are contactless payments - this is one of the highest contactless payment penetration figures in the world.

Some reasons cited for this preference include greater speed and efficiency, convenience, and ease of tracking financial records. Singaporeans generally prefer contactless payments for public transport, as they appreciate the speed of the payments and the convenience from not having to top up their stored-value travel cards.

Bank transfers

FAST

The Fast and Secure Transfers (FAST) intrabank service was launched in 2014, allowing nearly instant transfers of Singapore dollars between account holders of 24 major banks.

In February 2021, six non-bank financial establishments gained FAST access. This includes GrabPay, LiquidPay, MatchMove, Razer, Singtel Dash, and Wise.

PayNow

Consumers and businesses do bank transfers in Singapore primarily through PayNow, which runs on top of the FAST system. PayNow allows transfers with only the recipient’s mobile number, and is available across 21 participating banks and five participating Non-Bank Financial Institutions (NFIs) in Singapore. These include:

Banks

- ANEXT Bank

- ANZ Singapore

- BNP Paribas

- Bank of China

- CIMB Bank Berhad

- Citibank Singapore Limited

- DBS Bank/POSB

- Deutsche Bank

- Green Link Digital Bank (GLDB)

- GXS

- HSBC

- Industrial and Commercial Bank of China Limited

- JP Morgan

- MariBank

- Maybank

- OCBC Bank

- RHB Bank

- Sumitomo Mitsui Banking Corporation (SMBC)

- Standard Chartered Bank

- Trust Bank

- United Overseas Bank (UOB)

NFIs

- GrabPay

- LiquidPay

- Singtel Dash

- Xfers

- Nium

Provided free of charge, PayNow is very popular in Singapore. Individual registrations for PayNow increased by 1.6 million in 2020, while business registrations doubled to about 240,000 - this means that at least 80% of residents and businesses are on PayNow.

PayNow has also facilitated a major uptick in real-time payments in Singapore. In 2020, total real-time transactions reached 138.38 million, a 48% increase from 93.24 million in 2019. In the same period, the value of real-time transactions surged 40% to reach US$154 billion.

QR code payments

In 2018, the Monetary Authority of Singapore (MAS) launched the Singapore Quick Response Code (SGQR) – the world’s first unified payment QR code that combines multiple payment QR codes into a single SGQR label.

According to Visa, QR code payments are well received in Singapore, with at least 36% of respondents stating that they had used this payment method.

In November 2023, the MAS launched a proof of concept (POC) for an interoperable Singapore Quick Response Code Scheme (SGQR+). The POC, implemented with 23 payment schemes, spanned over 1,000 merchant acceptance points at the Singapore FinTech Festival (SFF) venue and the Changi district.

With SGQR+, merchants can eliminate the hassle of establishing commercial partnerships with individual payment providers on their own. MAS has appointed NETS and LiquidPay as the master acquirers of payment schemes. This means that just by connecting to SGQR+, merchants will have immediate access to a diverse range of existing and future local and cross-border payment schemes through a single touchpoint, which will in turn offer greater convenience for consumers.

Meanwhile, consumers can anticipate greater convenience using their preferred payment applications at more merchant acceptance points, while tourists will find it easier to transact using their native payment applications. This marks a significant step towards solidifying Singapore’s position as a key global player in QR payments.

Digital wallets

Digital wallets have gained significant traction in Singapore, climbing from 30.4% in 2020 to a projected 94.7% by 2025.

According to an IDC report commissioned by 2C2P, the mobile wallet user base reached 1.8 million in 2022. Mobile wallet usage will only continue to grow in the years to come, with the user base expected to reach 3.2 million by 2025.

Below are the top digital wallets used in Singapore:

- GrabPay: 35.3%

- FavePay: 23.5%

- DBS PayLah!: 18.8%

- Singtel Dash: 11.8%

- EZ-Link: 4.7%

- Others: 5.9%

Of these wallets, EZ-Link is notable for having started out as a contactless stored-value card used for public transit, not unlike Hong Kong’s Octopus card. It has since evolved to include a digital wallet accessed via a dedicated smartphone app.

Cross-border payment linkages

The 2023 IDC InfoBrief commissioned by 2C2P and Ant International highlighted that significant efforts are underway to enhance interoperability between the unique payments systems across Asia.

This will forge a more unified payments environment that spur increased online and offline commerce and revolutionise tourism spending. Consumers stand to benefit from enhanced convenience, enjoying seamless payments across the region. This is a particularly significant advantage when transacting with smaller businesses as they leverage technologies that facilitate the acceptance of preferred payment methods.

As of 2024, Singapore has connected its real-time payment systems with four countries’s RTP payment rails: Malaysia’s DuitNow, India’s UPI, Indonesia’s QR payment and Thailand’s PromptPay.

On a multilateral level, the BIS Innovation Hub Singapore Centre developed the Project Nexus initiative, exploring wider connectivity across SEA and other regions such as Europe. Regionally, the central banks of Indonesia, Malaysia, the Philippines, Singapore and Thailand are working towards connecting their domestic IPS through Nexus.

The role of the private sector has also been pivotal in the cross-border payments development. Notably, Alipay+ is the first in Asia to link up major mobile wallets such as DANA in Indonesia, Touch 'n Go in Malaysia, GCash in the Philippines, EZ-Link in Singapore, TrueMoney in Thailand, KakaoPay in South Korea, and more. This allows users to pay with their existing mobile wallets when travelling abroad, enabling easier transactions for both leisure and business.

Cash

Although Singapore has seen a steady decline in overall cash usage, cash has not entirely phased out. In 2020, Singaporeans made 37% of in-store purchases in cash for small day-to-day purchases at physical shops.

To further illustrate, although almost half of all 18,000 Singaporean hawkers (itinerant and semi-permanent food merchants) accept cashless payments, there are still many older hawkers who only accept cash.

Consumers will continue to use cash in Singapore. Although its usage is no longer widespread, it is still helpful for purchases of smaller transaction values.

Buy Now, Pay Later (BNPL)

The global popularity of BNPL has also reached Singapore’s shores. Given that the digital-savvy island nation was quick to adopt digital payments, it is little wonder that Singaporeans similarly embraced BNPL.

According to MAS, BNPL transactions in 2021 amounted to around $440 million. Although this accounted for less than 0.5% of the $103 billion in credit and debit card payments, BNPL usage will only continue to grow well into the future. The 2023 IDC InfoBrief predicts BNPL to gain in terms of e-commerce share. The forecast projects a 3% increase from 2022 to 2027E for BNPL, while other payment methods are expected to remain stable.

The interest-free, no-frills-attached nature of BNPL appeals to Singaporean millennials, who tend to be risk-averse in spending due to the repeated market volatilities they underwent during their formative years.

Seen as a “safer” alternative to credit-based Instalment Payment Plans (IPP), BNPL has thus been widely used by Singaporeans. KR-Asia notes that approximately 48% of BNPL purchases were for smaller purchases that cost SGD 100 or less.

In 2022, the BNPL Code of Conduct was launched to protect consumers against debt. This includes creditworthiness safeguards and guidelines for ethical marketing practices.

Key BNPL players in Singapore include Atome, Grab PayLater, LatitudePay, ShopBack Pay Later (formerly hoolah) and SeaMoney.

The rise of BNPL platforms has, however, resulted in intense competition between different players. As the BNPL space became more saturated, several providers in Singapore, such as Pace and Zip were forced to either exit or close.

Digital payments run the show in Singapore

Singapore’s efforts to be digital-first have had a tremendous impact on its payments landscape. Many Singaporeans are receptive to the breadth of available digital payment methods, especially those that allow them to complete transactions contactless.

Looking to the future, digital payments will only continue to gain traction in Singapore. As the landscape continues to evolve rapidly, we can expect Singaporeans to get fully onboard with any developments.

Read more on Popular Payment Methods

Learn more about the top payment methods around the world. Check out the other articles in our Popular Payment Methods series:

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 400 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 600,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further in Singapore? Our friendly team is ready to help - talk to us today.