Popular Payment Methods in Thailand: What Consumers Want

Boasting a population of 71.6 million, Thailand is the second largest economy in Southeast Asia with a GDP of just over US$500 billion. Like Indonesia and the Philippines, Thailand’s payments landscape was traditionally cash-dominated. Back in 2017, the Bank of Thailand reported that 93% of daily transactions in the kingdom were in cash.

However, this changed rapidly during COVID-19 - the pandemic accelerated the Thais’ adoption of digital payments, with the transaction value of digital commerce soaring from about US$15 million in 2020 to US$31 million in 2023. This figure is projected to climb to US$51 million in 2027.

Thailand boasts a mobile-first, tech-savvy digital generation. In 2019, Thailand topped global digital rankings with a high mobile penetration rate of 133% and 55 million active mobile Internet users. With the impact of COVID-19, mobile penetration rate rose up to 141% in early 2023 and a total of 101.2 million active cellular mobile connections, according to DataReportal. With this trend, it’s apparent that the Thais are highly receptive to digital payments.

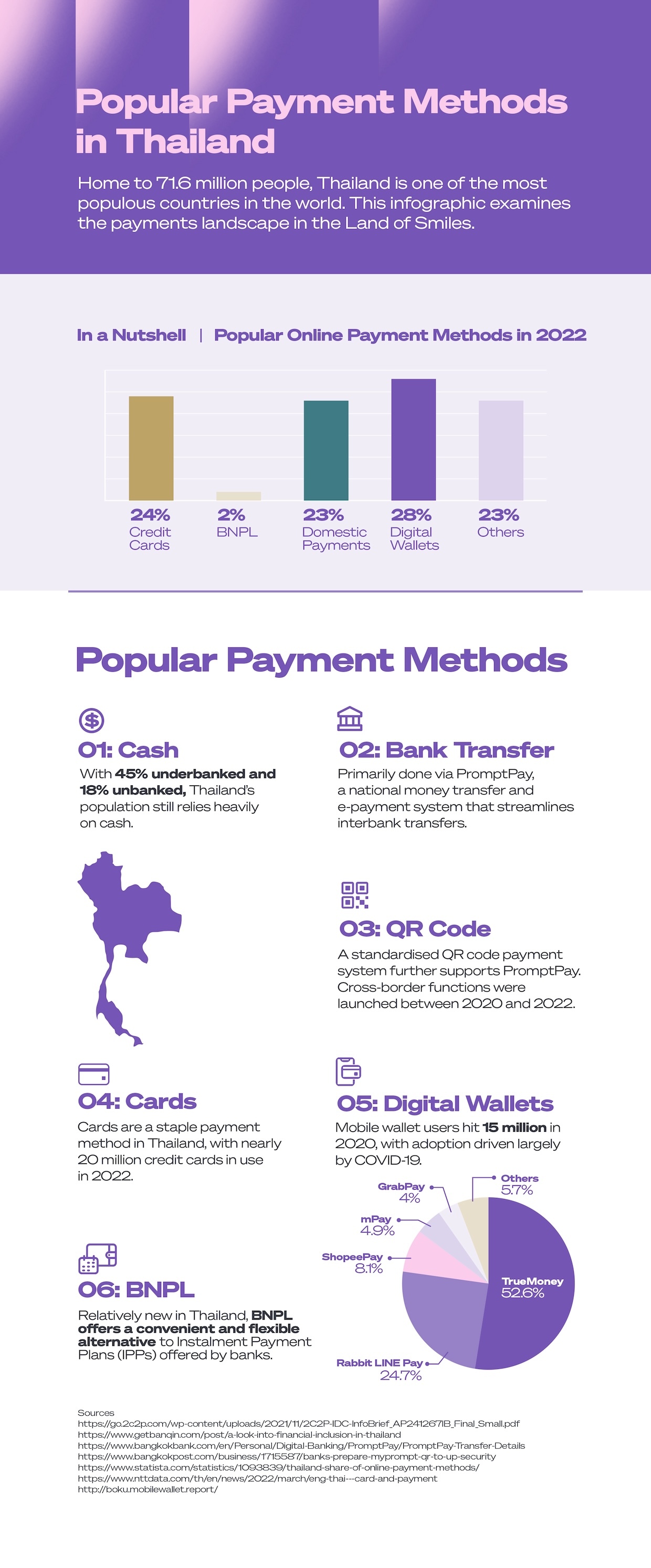

In this article, we will explore the most popular payment methods in Thailand, summarised as follows:

- Cash, but digital is growing rapidly

- Bank transfer

- QR code payment

- Digital wallets

- Cards

- Buy Now, Pay Later (BNPL)

Cash, but digital is growing rapidly

Cash has been a long-standing staple in Thailand's payments landscape, but recent trends suggest a gradual shift away from its usage. In 2022, cash transactions accounted for 50% of all point of sale (POS) payments, which marks a 7% decline as compared to the previous year.

Despite the decline, Thailand's share of cash usage remains one of the highest in Asia. This preference for cash is attributed to Thailand’s underbanked and unbanked populations, who make up 45% and 18% of the country’s total population respectively. According to Banqin’s article on financial inclusion, the underbanked often only own one deposit account, while the unbanked have no access to financial services and products.

Government’s push for digital transformation

Despite the enduring preference for cash in Thailand, the government has taken measures to shift the kingdom towards a digital future.

Since 2016, the Thai government has been pursuing its Digital Economy and Society Development Plan. The core vision of this plan is to transform the country into “Digital Thailand”, which the government defines as:

“A transformed Thailand that maximises the use of digital technologies in all socio-economic activities in order to develop infrastructure, innovation, data, human capital, and other digital resources that will ultimately drive the country towards wealth, stability, and sustainability.”

Also dubbed Thailand’s 4.0 Revolution, the government’s digital transformation initiative has made significant headway since its inception.

Specific to the digitalisation of payments, the Thai government rolled out a National E-Payment Master Plan, which outlines a framework to develop the infrastructure and connections necessary to enable digital payments in Thailand.

Under this plan, the following core endeavours were established:

- Introduction of the PromptPay system to enable transactions with national IDs and/or phone numbers

- Expansion of Electronic Data Capture (EDC) networks and tools to eliminate cash

- Digitalisation of the tax system

- A state e-payment system for efficient welfare distribution

- Promotion of electronic payment systems

The Bank of Thailand’s support for digital payments

To support the government’s National E-Payment Master Plan, Thailand’s central bank, the Bank of Thailand, outlined a Payment Systems Roadmap. This roadmap sought to make digital payment methods the preferred choice for Thais. The first step taken was to establish foreign remittance connections with the central banks of Singapore and Malaysia.

In March 2022, the Bank of Thailand announced new banking initiatives to further support the digital economy. Some of the proposals included provisions for open and virtual banking, which the Bank of Thailand plans to roll out in 2025.

With the Thai government and the Bank of Thailand driving digital payments forward in Thailand, the kingdom can realistically see the use of cash phasing out in the future.

Bank transfer

Bank transfers in Thailand are predominantly made using PromptPay, a national money transfer and e-payment system launched in 2017. This system aims to reduce cash use and lower overall bank transfer fees. To use PromptPay for interbank transfers, users only need their national ID card number and/or mobile phone number.

PromptPay was a resounding success within four months of its launch, with at least 4 billion baht in 7.5 million transactions transferred through the system. By June 2017, at least 28.3 million Thais had registered with PromptPay.

Today, PromptPay is a leading digital payment method in Thailand, with 67 million registered users recorded in 2023.

QR code payment

In the same year of PromptPay’s launch (2017), Mastercard, Visa, and UnionPay International collaborated to introduce a standardised QR code payment system to support the Bank of Thailand’s digital payment initiatives.

Similar to the Philippines’ BSP National QR Code Standard (QRPh) and Indonesia’s Quick Response Code Indonesia Standard (QRIS), this affordable and straightforward system requires merchants to display just one QR code for consumers to scan and make payments. The method leverages the same technology as PromptPay to facilitate money transfers.

According to the Bank of Thailand, “QR code technology is one of the payment methods to increase consumers’ financial service accessibility, improve operational efficiency and lower business costs.”

Beginning with domestic payments, Thailand’s standardised QR code system was later extended to five commercial banks: Siam Commercial Bank, Kasikornbank, Bangkok Bank, Krungthai Bank, and the Bank of Ayudhya.

Cross-border interbank functionality was recently integrated with the QR code payment system, with linkages formed with Indonesia, Malaysia, Vietnam, Cambodia, Singapore, and Japan.

Thai QR proved to be a popular payment option in Thailand. In 2020, up to 13.39 million transactions were recorded to have been made via the system - this is a 49.14% increase from 2019. There are also over 7.4 million QR payment acceptance points distributed across Thailand as of August 2020.

Digital wallets

Digital wallet usage has risen in prominence in Thailand. According to a Statista report on point of sale (POS) payment methods in Thailand, digital wallet usage jumped from 2% in 2017 to 23% in 2022. Additionally, digital wallets accounted for 25% of total e-commerce transaction value. This positions digital wallets as the second most used payment method for both e-commerce and POS transactions in 2022.

In 2020, the mobile wallet user base reached 15 million (21% of the total population), with transactions adding up to a value of $492 million. Mobile wallet usage is set to continue growing well into the future, with our commissioned IDC infobrief projecting that mobile wallet payments will make up 29% of all ecommerce payments in Thailand by 2027.

Below are the top digital wallets used in Thailand:

- TrueMoney: 52.6%

- Rabbit LINE Pay: 24.7%

- ShopeePay: 8.1%

- mPay: 4.9%

- GrabPay: 4%

- Others: 5.7%

Cards

Cards continue to be a popular payment method in Thailand, making up almost a quarter of all ecommerce payments in 2022. In 2020, credit cards accounted for 32% of all online payments.

This is despite Thailand not recording very high card penetration rates, which stand at 0.77 debit cards and 0.29 credit cards per capita. According to a GlobalData report, consumers’ preference for credit and charge cards can be attributed to the cards’ reward benefits, including discounts, cashback, and instalment payment facilities.

Although the same GlobalData report revealed that payment card transaction value declined by 11.7% between 2019 and 2020 due to COVID-19, this drop has begun to be offset by the QR code payment system. Thais have increasingly linked their credit cards to the system to make QR-based payments within and across borders.

As of 2022, there are nearly 20 million credit cards in use in Thailand.

Instalment Payment Plan of Credit Cards (IPP)

Credit cards offer consumers convenience as both a payment vehicle and a source of short-term credit. In Thailand, leading financial institutions offer cardholders instalment plans, often with minimal interest fees. Examples include Bangkok Bank’s "Be Smart" Instalment Plan and Siam Commercial Bank Easy Net’s Deejung Instalment Plan, which allow credit card customers to spread payments for up to 10 months as well as earn cardholder programme points.

Buy Now, Pay Later (BNPL)

BNPL has recently taken the world by storm, and Thailand is no exception. In 2020, BNPL spending on ecommerce in Thailand amounted to US$0.13 million. BNPL is projected to grow by 92.1% to US$1,715.2 million in 2022. By 2028, the gross merchandise value (GMV) of BNPL in Thailand is expected to reach US$16,529.9 million, according to IBS Intelligence.

BNPL is especially appealing to young Thais, given that this instalment-based plan is interest-free and does not require a credit card. This gives consumers more flexibility to pay for their purchases in small, manageable monthly instalments.

Key BNPL players who have set up operations in Thailand include Atome and Pine Labs.

Thailand will continue charting its digital-first roadmap

While cash is still widely used in Thailand, the kingdom has made great strides in digitalising its payments landscape. PromptPay has played a significant role in driving Thailand’s digital transformation, and its expansion into a QR code payment system has accelerated the adoption of digital payments kingdom-wide.

With both the government and central bank directly involved in Thailand’s digital transformation, the kingdom seems on track to attain its goal of becoming digital-first.

Read more on Popular Payment Methods

Learn more about the top payment methods around the world. Check out the other articles in our Popular Payment Methods series:

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 400 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 600,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to take your business further in Thailand? Our friendly team is ready to help - talk to us today.