Setting the Stage for Digital Transformation in Vietnam

Contributed by Lee Nguyen, Country Head of 2C2P Vietnam

In one of the most dynamic emerging economies in Southeast Asia, cash is still king. Despite Vietnam’s accelerating digital adoption spurred by the pandemic, many merchants and consumers in the country still rely heavily on cash for transactions.

Nonetheless, the future of digital payments looks promising. Vietnam has the fastest-growing digital economy in Southeast Asia, powered by a growing e-commerce sector. According to the IDC InfoBrief commissioned by 2C2P and MRC, traditional payment methods constitute just 11% of the total e-commerce payments market in 2022, and is expected to drop to 6% by 2025.

In this article, I’ll start with a deep dive into Vietnam’s digital payments landscape, looking at the main drivers of its shift towards digitalisation. Then I’ll share my thoughts on the evolving opportunities in payment methods and how 2C2P is supporting the market through its digital transformation.

Cash Reigns in Vietnam

Trust and Security

While they acknowledge the convenience of online banking and non-cash methods, many Vietnamese require greater assurance of these methods’ security and reliability in light of fraud issues. For example, there have been recent cases of bank customers losing billions of dong through fraudulent internet bank transfers done via stolen SIM cards.

Pros and Cons for SMEs

Some businesses, mostly small and medium-sized enterprises (SMEs), still prefer to receive cash payments to minimise tax claims. Occasionally, businesses give 2-3% discounts for cash payments, which may be a more lucrative option in the short term.

As merchants still deem cash the simplest way to accept payments, many shops – especially small family-owned businesses – do not have non-cash payment acceptance points, such as POS systems.

However, more consumers are adopting e-wallets, and this shift will no doubt add to the push towards wider acceptance of non-cash payments. By 2026, Vietnam is projected to gain almost 43 million new e-wallet users, so I see the shift from cash gaining more momentum soon.

Government Driving the Adoption of Digital Payments

Aside from the evolving consumer behaviour, government initiatives are another factor driving digitalisation forward in Vietnam.

In 2020, then-Prime Minister Nguyen Xuan Phuc issued Directive No. 22/CT-TTg to promote non-cash payments. The legislation instructed the State Bank of Vietnam (SBV) and the Ministries of Industry and Trade, Finance, Health, Education and Training, and Transport to develop mechanisms and policies to encourage cashless and electronic payments.

NAPAS and Its Roles

SBV has been supporting the National Payment Corporation of Vietnam (NAPAS) in its development over the last five years. NAPAS provides an electronic payment infrastructure and services like financial switching and electronic clearing for banks and payment companies.

NAPAS provides an inter-bank payment service for transactions below 500 million VND, while SBV manages larger transactions through the older IBPS system.

In the future, NAPAS will also offer an inter-wallet payment service to transfer money from one e-wallet to another and serve as the single point of integration for cross-border transactions. It will connect to other national payment systems, such as India’s Unified Payments Interface (UPI).

VietQR

NAPAS also manages and operates VietQR, which has become the national QR standard used by all banks and e-payment companies in Vietnam. The recent cross-border QR payment linkage of VietQR and Thai QR enables tourists from both countries to make convenient cross-border transactions via mobile banking applications of participating banks.

Data for eKYC

Vietnam’s Ministry of Public Security plans to provide eKYC (Electronic Know Your Customer) data and services to financial institutes to make digital onboarding and transactions much more secure. Now, the government has tasked them with building a centralised database of all citizens, with approval to share selected information with financial institutions to enhance eKYC.

Reporting for Efficient Tax Collection

The government has instructed SMEs to report their transactions on a daily basis to get real-time tax estimations. As well as supporting efforts to steer Vietnam away from cash and towards non-cash payments, this move provides better payment control and allows the government to collect taxes more quickly and efficiently.

National Cashless Day

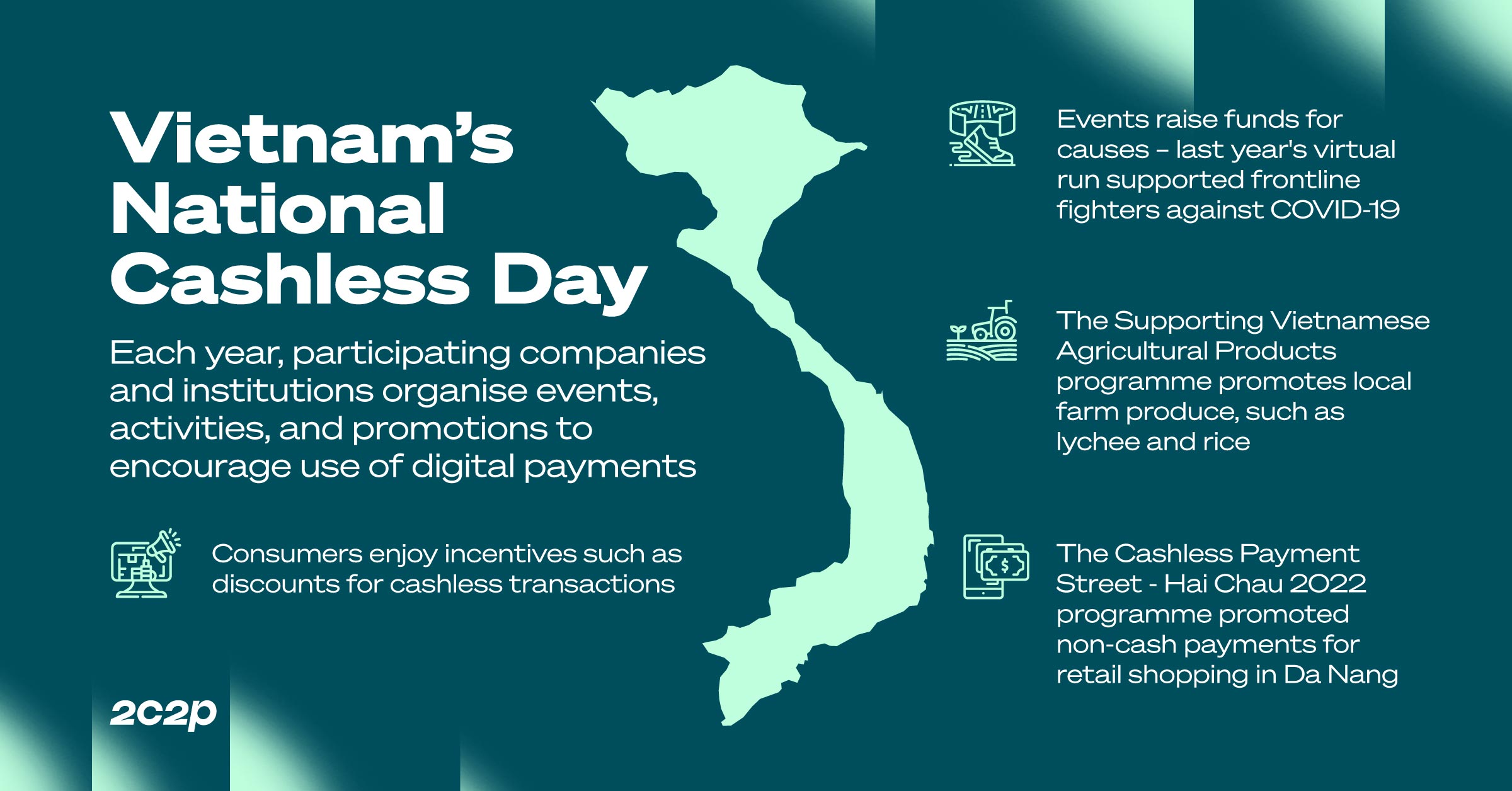

Since 2019, Vietnam has been observing National Cashless Day on 16 June. This started out as an SBV public awareness campaign to encourage a change in customer behaviour. We've gradually started seeing more support from industry players and fundamental changes taking effect.

Incentives for Consumers

During Cashless Day, participating companies and institutions such as Visa and Sacombank offer incentives to encourage cashless transactions. These incentives range from promotional discounts and cashback incentives to limited-time benefits for eligible customers. Sacombank, for example, offered refunds of up to 200,000 VND (US$8) for customers making payments or travel bookings using QR codes through Sacombank Pay or mBanking applications, and a 40% discount on Liberty travel insurance.

Support for Businesses

The Saigon Union of Trading Cooperatives (Saigon Co.op) has been collaborating with the youth newspaper Tuoi Tre and e-wallet Momo for a 20-day Supporting Vietnamese Agricultural Products programme to help the local agricultural sector. Last year, 75 tonnes of locally-grown lychees were sold through the Momo e-wallet platform.

This year, all shops along two streets in the Hai Chau District in downtown Da Nang have gone cashless as part of the “Cashless Payment Street - Hai Chau 2022” programme led by Da Nang’s People’s Committee, the Vietnam E-commerce Association, and Momo. The scheme aims to stimulate local shopping demand and promote non-cash payments through digital technology, discounts and incentives.

In the coming years, Cashless Day will likely expand with more events and activities. Currently, individual businesses like the major e-commerce platforms run their own discount campaigns, but combining discount programmes with other players will generate even more traffic and transactions.

Notable Digital Payments Trends

Digital Wallets are Dominating

Vietnam has a crowded digital wallet market, with more than 40 digital wallet providers currently competing for market share. There are three notable factors behind the rapid growth of mobile wallets in Vietnam:

First, e-wallets offer much more convenience than bank accounts, making them especially suitable for the younger generation – they can easily set up an e-wallet account for themselves or their children, and transfer money to friends and parents. On the one hand, banking is more formal and takes time, but that’s where you would store your ‘big money’; e-wallets are where you’d keep your ‘small money’ for quick accessibility and easy usage.

Second, after 15 years of development, e-wallets are now widely adopted by all major e-commerce platforms. In fact, many of these platforms often encourage the use of digital wallets for transactions.

And third, e-wallets run many discounting campaigns to grow their customer base, making them enticing to customers.

However, soon we’ll see more M&As between e-wallets, as well as tightened control in issuing new payments and e-wallet licences. With close to 50 e-wallet providers present, SBV has recently devised a strategy to better control and streamline the e-wallet market, with some licences being revoked. We’ll also start to see more segmentation as e-wallets focus more on their own vertical segment and customers.

Buy Now, Pay Later (BNPL) is Meeting Market Needs

BNPL is popular across Southeast Asia because it answers a real market need. Essentially, it offers an accessible alternative to credit cards, allowing consumers to break up big-ticket purchases into more manageable instalments.

This makes BNPL especially appealing iIn Vietnam, where card penetration rates are notably low. For example, younger millennial and Gen Z users are usually unlikely or unable to use credit cards, making BNPL one of their only options for larger purchases. BNPL is still in the early stages in Vietnam, but its appeal will only grow as more e-commerce platforms and e-payment providers adopt it in the next few years.

Read more: Popular Payment Methods in Vietnam

Outlook on Digital Payments in Vietnam

Fintechs and e-payment companies alone do not just spur the shifts in the digital payment landscape in Vietnam, with other players, such as banks playing a role. Many banks have begun building Digital Core and Open Banking services to cater to customers directly, providing services that overlap those offered by fintechs. Banks also work with fintechs to co-provide services.

We’re also seeing telecommunications companies becoming an integral part of the ecosystem, with Mobile Money playing a significant role in Vietnam’s digital payments landscape. Mobile Money enables users to use their registered mobile phone accounts to conduct various transactions, making cashless payments accessible to all, even those without smartphones. It especially benefits people in rural, mountainous, and remote areas where 60% of Vietnam’s population lives. Users can easily make top-ups or pay for services and goods of small value without a bank account or e-wallet – their Mobile Money account is linked to their registered mobile number, eliminating the need for eKYC.

While NAPAS has done well in enabling inter-bank transactions, there has yet to be an inter-wallet service. The market now needs links between banks and e-wallets to make it easier for customers to move money between accounts.

On a similar note, Vietnam needs to join the cross-border trend with other countries in the region. Building support for inter-wallet services, even across borders, would expand payment options for tourists and business travellers – both Vietnamese ones looking to use their local e-wallets overseas, as well as visitors looking to do the same in Vietnam.

The 2C2P Difference in Vietnam

The accelerating adoption of new payment methods like mobile wallets, and the increased diversity of providers for these payment methods, present new challenges for businesses, especially in terms of operations complexity and costs. As an agile player that constantly preempts shifts in Vietnam's fast-evolving payments landscape, 2C2P can help businesses solve these challenges and leverage the popularity of new payment methods for their own growth.

We function as an Omni Payment Controller for local businesses, unifying all the payment channels that they are using. Beyond that, we give businesses the tools they need to optimise how they handle payments: from options to auto-route transactions through the most cost-efficient routes, to features that help standardise payment workflows and streamline cash flow between payment channels. All of this simplifies the work of offering and managing different payment channels, so that businesses can offer the most widely used and convenient payment options to customers without worrying about the added operational strain.

Local businesses that are eager to grow often need to collect payments in both Vietnam and other countries via credit card and alternative payment method (APM) schemes. 2C2P is the best partner for such companies looking to expand to the international market. Our cross-border capabilities and regional coverage are unrivalled, covering most major payment schemes, and we're the only provider in Vietnam that can provide these services to large enterprises.

On top of being a payments provider that is well-positioned for cross-border transactions, we also want to provide other value-added services like digital goods, corporate biller and corporate loyalty for SMEs, as well as pursue our own Intermediary Payment licence by M&A to offer more quality services and do further acquiring in the Vietnam market.

About 2C2P

2C2P is a full-suite payments platform helping businesses securely accept payments across online, mobile and offline channels, as well as providing issuing, payout, remittance and digital goods services.

With over 250 payment options ranging from credit cards to mobile wallets and an alternative payments network of more than 400,000 physical locations, 2C2P is the preferred payments platform of tech giants, airlines, online marketplaces, retailers and other global enterprises.

Want to get involved? 2C2P is hiring in Vietnam! If you’re interested in joining our fast-growing team and helping to further Vietnam’s digital payments transformation, head over to our Careers page.